US National Debt skyrockets by $275B in 24 hours.

The national debt increased by $275 billion in one day, skyrocketing to more than $33.442 trillion, according to the Treasury Department’s updated Debt to the Penny dataset.

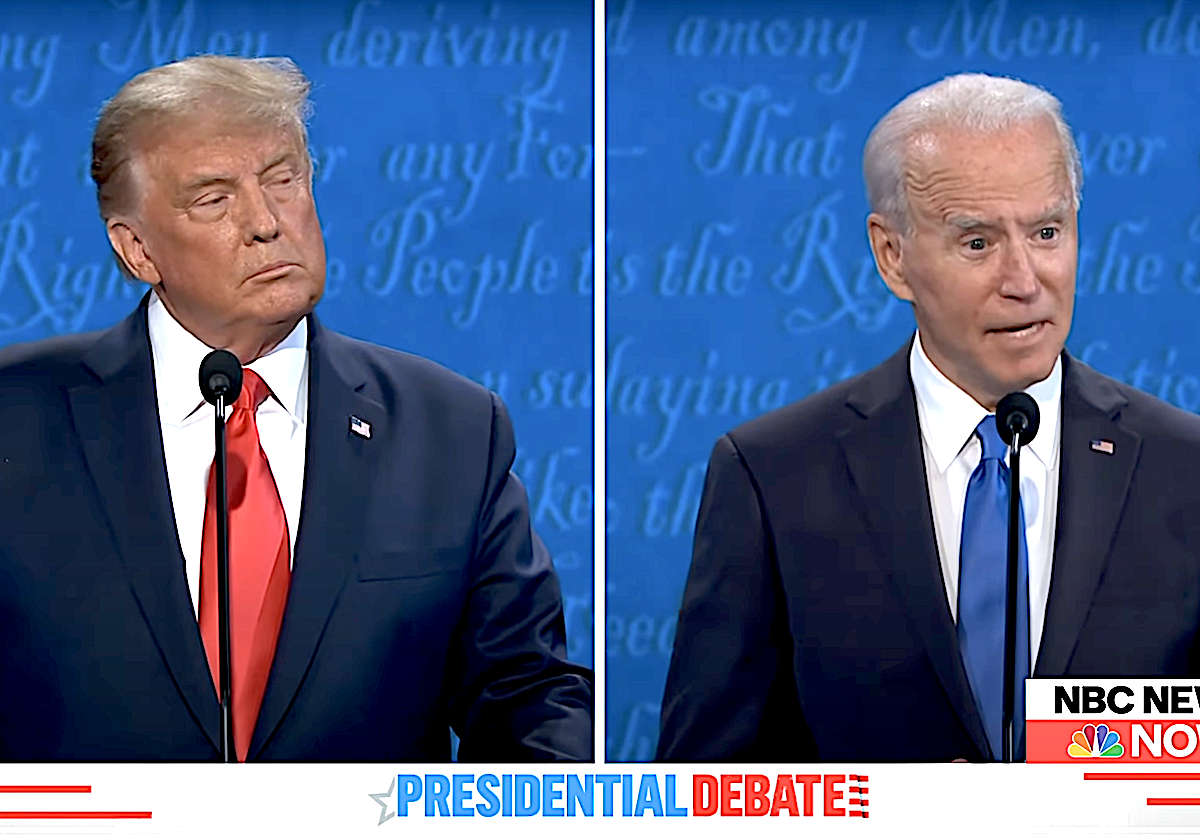

In a single month, the national debt saw a more than $600 billion surge. Since President Joe Biden and former House Speaker Kevin McCarthy (R-Calif.) reached a debt-ceiling agreement, the federal government’s total public debt outstanding has risen by nearly $2 trillion.

The U.S. debt challenges come as the federal deficit is on track to reach $2 trillion.

During the volatile situation in Washington, a chorus of hardline conservative Republicans have demanded accountability, action, and leadership changes to address the accelerating national debt.

Rep. Victoria Spartz (R-Ind.), for example, threatened to resign if a commission to tackle the national debt and above-trend inflation isn’t established by the end of the year.

“I will not continue sacrificing my children for this circus with a complete absence of leadership, vision, and spine. I cannot save this Republic alone,” Ms. Spartz said in an Oct. 2 statement.

But lawmakers aren’t the only ones sounding the alarm over intensifying U.S. debt obligations. Many economists and market analysts have recently alluded to a potential debt crisis, especially as interest rates and Treasury yields soar.

“We’re staring at about $20 trillion of debt over the next 10 years, which will bring us over well over $50 trillion in a decade from now,” Les Rubin, an economist and founder and CEO of Main Street Economics, told The Epoch Times. “All of which is unsustainable, and that’s exactly what the Treasury Department reports: The fiscal path is unsustainable, and there’s no sign of it slowing down and getting that.”

The U.S. government has no intention of repaying this debt, which could force investors to hit the bond-buying pause button, he said.

“When investors everywhere stop having confidence, that’s a cataclysmic problem that will resound throughout the world,” Mr. Rubin said.

Investor confidence and demand have become increasing concerns on Wall Street.

‘A Debt Crisis’

In October 2022, Treasury Secretary Janet Yellen told the Securities Industry and Financial Markets Association’s (SIFMA) annual meeting in New York that there had been a decline of ”adequate liquidity” in the enormous Treasury market, adding to overall debt-servicing costs.

In the third quarter, the Treasury was projected to borrow approximately $1 trillion. In the fourth quarter, the Treasury adjusted its borrowing estimates by about $100 billion, to $852 billion. This was in addition to the second-quarter debt issuance of $657 billion.

However, demand for Treasury securities has fallen since the Fitch Ratings downgrade this past summer.

“That announcement really marked the start of the Treasury bond market’s concern about too much supply relative to demand,” Yardeni Research stated in a note. “The 10-year bond yield was 4.05 percent on Aug. 1. Now it is almost 4.80 percent.”

The two-, 10-, and 30-year Treasury yields recently touched their highest levels in 16 years. The yields retreated during the Oct. 4 session on a weaker-than-expected private payrolls report from ADP.

With the Federal Reserve and other central banks raising interest rates to the highest levels in years, growing government debt burns could ripple throughout the global bond market, Goldman Sachs Research noted.

“If you add to that central banks no longer running this easy policy, we find that there are now consequences for running high debt-to-GDP ratios, which is that your interest costs will increase, and if your growth rates and inflation rates don’t keep pace over time, then there is a question mark about who will buy these bonds,” wrote George Cole, Goldman Sachs research head of European rates strategy.

Speaking at CNBC’s Delivering Alpha conference on Sept. 28, Pershing Square Capital Management’s Bill Ackman said he thinks the U.S. government will continue to pump more bonds into the Treasury market to support the ballooning debt and deficits, even amid diminishing demand.

In the current fiscal year to date, federal spending has risen by 3 percent, and tax revenues have slumped by 10 percent. According to White House budget projections, cumulative deficits are forecast to total more than $17 trillion. Even with the Fiscal Responsibility Act—the name of the debt-limit deal made by President Biden and Mr. McCarthy—cumulative shortfalls are expected to be $1.5 trillion lower.

Ray Dalio, founder of Bridgewater Associates, warned that the United States is “going to have a debt crisis in this country.”

“How fast it transpires, I think, is going to be a function of that supply-demand issue, so I’m watching that very closely,” Mr. Dalio said on Sept. 28 in an interview with CNBC.

Interest Payments

Interest payments have become the second-largest budgetary item. In the first 11 months of the current fiscal year, total debt-servicing payments have exceeded $864 billion. By comparison, Social Security spending has reached $1.238 trillion, while defense spending has surpassed $736 billion.

In the next decade, interest payments will total approximately $10.6 trillion, making it the fastest-growing outlay in the federal budget. One of the concerns is that this will crowd out the nation’s investments in other budget items, such as defense, education, research and development, and transportation. Growing net interest expenses could also threaten the federal government’s ability to sustain current programs.

Economists at the Federal Reserve Bank of St. Louis claim that more pressures will be associated with rolling over maturing U.S. government debt amid a rising-rate climate.

“The longer interest rates stay high, more and more of the [fixed-rate marketable portion of the U.S. debt] will be rolled over at higher rates, continuing to cause interest payments by the government to become a larger and larger portion of the budget,” staff economists wrote in a June paper.

If interest continues to consume a substantial portion of the budget every year, it forces the nation’s capital to borrow more, according to Mr. Rubin. Borrowing costs will keep climbing because interest rates need to be high enough so that the Treasury can attract enough funding to service the ballooning national debt, he said.

“It never gets to the point where you can balance the budget,” he said.

What are the potential consequences of the growing national debt on the economy and future generations?

The alarm about the growing national debt. Economists and financial experts have expressed concerns about the potential consequences of such a massive debt burden on the economy and future generations.

The national debt refers to the total amount of money that the United States government owes to its creditors, which includes individuals, institutions, and foreign governments. As of the latest update from the Treasury Department, the national debt has surpassed $33.442 trillion, an increase of $275 billion in just one day. This sharp rise highlights the alarming rate at which the debt is accumulating.

In addition to the daily increase, the national debt has seen a surge of over $600 billion in just a month. This surge can be attributed to the debt-ceiling agreement reached between President Joe Biden and former House Speaker Kevin McCarthy. Since the agreement, the federal government’s total public debt outstanding has risen by almost $2 trillion.

The increasing national debt poses significant challenges for the United States. With the federal deficit on track to reach $2 trillion, it is crucial to address this issue urgently. Failure to do so may have serious implications for the country’s financial stability and economic growth.

In response to the rising debt, several conservative Republicans have called for accountability, action, and leadership changes in Washington. Representative Victoria Spartz from Indiana, for instance, has threatened to resign if a commission to tackle the national debt and above-trend inflation is not established by the end of the year. She emphasizes the need for strong leadership and a clear vision to address the pressing issue.

The concerns raised by lawmakers, economists, and financial experts highlight the urgency of addressing the national debt. It is essential for the government to formulate effective strategies to curtail spending, increase revenue, and prioritize responsible financial management. Failure to do so may result in severe consequences for the economy, future generations, and the overall stability of the nation.

The current situation calls for collaboration and bipartisan efforts to find sustainable solutions to reduce the national debt. It is crucial for policymakers to work towards fiscal responsibility and make informed decisions that will secure the country’s financial future.

In conclusion, the national debt in the United States has reached unprecedented levels, posing significant challenges for the economy and future generations. Urgent action is required to address this issue, and lawmakers, economists, and financial experts are sounding the alarm. By implementing responsible financial management strategies and promoting fiscal responsibility, the government can work towards reducing the national debt and ensuring a stable and prosperous future for the nation.

" Conservative News Daily does not always share or support the views and opinions expressed here; they are just those of the writer."