Japan’s core inflation eases, supporting the belief that the BOJ will maintain its current stance.

Japan’s Core Consumer Prices Slow in July

By Tetsushi Kajimoto

TOKYO (Reuters) – Japan’s core consumer prices slowed in July, supporting expectations the Bank of Japan (BOJ) will be in no rush to phase out monetary easing, even as inflation remains stubbornly above the central bank’s target.

The 3.1% rise in the core consumer price index (CPI), which includes oil products but excludes volatile fresh food prices, matched a median market forecast, following a 3.3% increase in the previous month. It held above the BOJ’s 2% inflation target for the 16th straight month.

The so-called core-core inflation index, which excludes fresh food and energy prices and is closely watched by the BOJ as a better gauge of trend inflation, rose 4.3% year-on-year in July, accelerating from the previous month.

The central bank argues that wage pressures have yet to build up enough to warrant a fresh tweak to the ultra-loose monetary stance.

Still, analysts say an acceleration in service-led inflation is a positive sign that demand-side inflation, which the BOJ is looking to stoke, may be building.

“The data confirmed that price pressures are rising in service-sector such as accommodation as well as food, while import inflation including energy is calming down,” said Takeshi Minami, chief economist at Norinchukin Research Institute.

Gabriel Ng, economist at Capital Economics, said the key question is whether services inflation can pick up the baton.

“With unit labour costs barely rising and consumer spending starting to falter as real incomes are falling sharply, we doubt that it will,” said Ng.

“Accordingly, we still expect the Bank of Japan to keep its short-term policy rate unchanged for the foreseeable future.”

Food costs were among the major contributors to the overall inflation due to elevated prices of raw materials.

The data comes after the BOJ’s closely watched policy meeting late last month in which the central bank tweaked monetary policy to allow the 10-year bond yield cap to move more flexibly.

BOJ Governor Kazuo Ueda has stressed the need to keep policy ultra-loose until cost-push inflation shifts into one driven by robust domestic demand and higher wage growth.

Under the BOJ’s yield curve control, the bank guides short-term interest rates at -0.1% and buys huge amounts of government bonds to cap the 10-year bond yield around 0% as part of efforts to fire up inflation to its 2% target.

(Reporting by Tetsushi Kajimoto. Editing by Sam Holmes)

Prosecutors Announce Breakthrough in Murder Case

President Peters Faces Scrutiny, Senator Moore Defends Trump

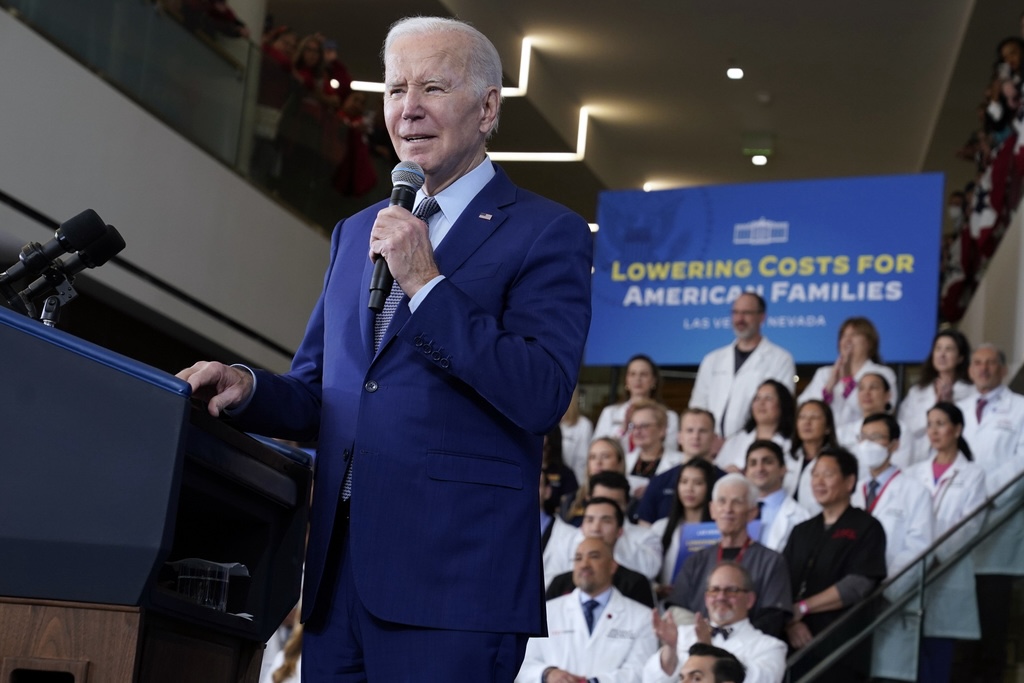

Biden Challenges Critics on Anniversary of ‘Inflation-Reduction Act’

Former Chief of Staff Mark Meadows Moves Case to Federal Court

Applied Materials Forecasts Strong Fourth-Quarter Profit

Microsoft to Sell New Version of Databricks Software

Judge Dismisses Lawsuit Against YouTube

Cybersecurity Firm Mandiant Sees Increased Use of AI

" Conservative News Daily does not always share or support the views and opinions expressed here; they are just those of the writer."