Key Fed Inflation Measure Rose More Than Expected in January

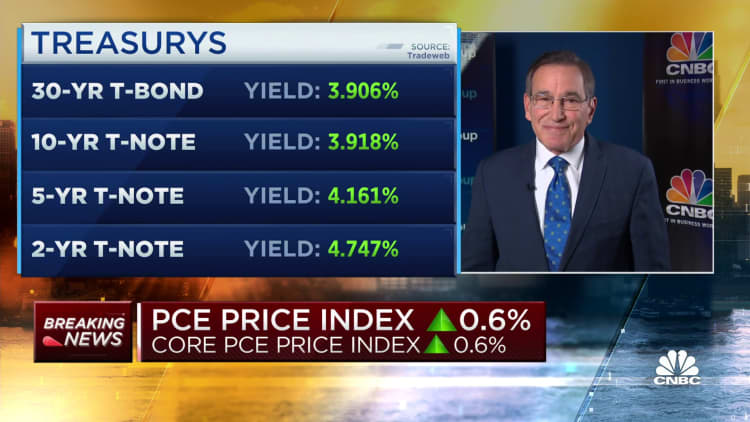

- Core personal consumption expenditures price index rose 0.6% in the month and was 4.7% higher than a year ago.

- Headline inflation rose by 0.6% and 5.4%, respectively. All figures were higher than expected.

- These numbers indicate that inflation has accelerated in the new year. This puts the Fed in a position to continue raising interest rates.

The Federal Reserve closely monitors inflation to determine if it rose above expectations in January. This indicates that the central bank still has a lot of work to do to lower prices.

The Commerce Department reported Friday that the personal consumption expenditures price index, which excludes food, increased 0.6% and was 4.7% higher than a year ago. Wall Street was expecting readings of 4.4% and 0.5%, respectively.

Inflation was higher for volatile food and energy components than it was for headlines.

Markets plunged following the releaseFutures linked to the Dow Jones Industrial Average are off over 300 points.

As prices rose, consumer spending rose 1.8% compared to the 1.4% estimate. Personal income increased 1.4% which is higher than the 1.2% estimate. The personal savings rate also increased to 4.7%, an increase of 1.4% above the estimate.

All the data suggest that inflation has accelerated to begin the new year. This puts the Fed in a position to likely continue raising interest rates. Inflation reached its highest level for 41 years and the central bank has raised benchmark rates by 4.5 points since March 2022.

The Fed closely follows PCE measures than any other inflation metrics. This is because the index adjusts to consumer spending habits like substituting cheaper goods for better ones. This gives a better picture of the cost-of-living.

Core inflation is a more important focus for policymakers, as it gives them a better long-term view of inflation. However, the Fed tracks headline PCE.

According to Friday’s report, January’s inflation surge was largely due to a 2% increase in energy prices. Food prices rose 0.4%. Both services and goods both increased 0.6%

Annually, food prices increased 11.1% while energy prices rose 9.6%.

Earlier Friday, Cleveland Fed President Loretta Mester CNBC interview There has been some progress, but “the level of inflation is still too high.”

Mester, a non-voting member of Federal Open Market Committee that sets rates, has been advocating for aggressive increases. She indicated that she was unsure if she would advocate for another half percentage point increase at the March FOMC meeting.

CME Group data shows that market prices rose in the wake Friday’s data. They increased for the possibility of a half point (or 50 basis points) increase next month to 33%.

" Conservative News Daily does not always share or support the views and opinions expressed here; they are just those of the writer."