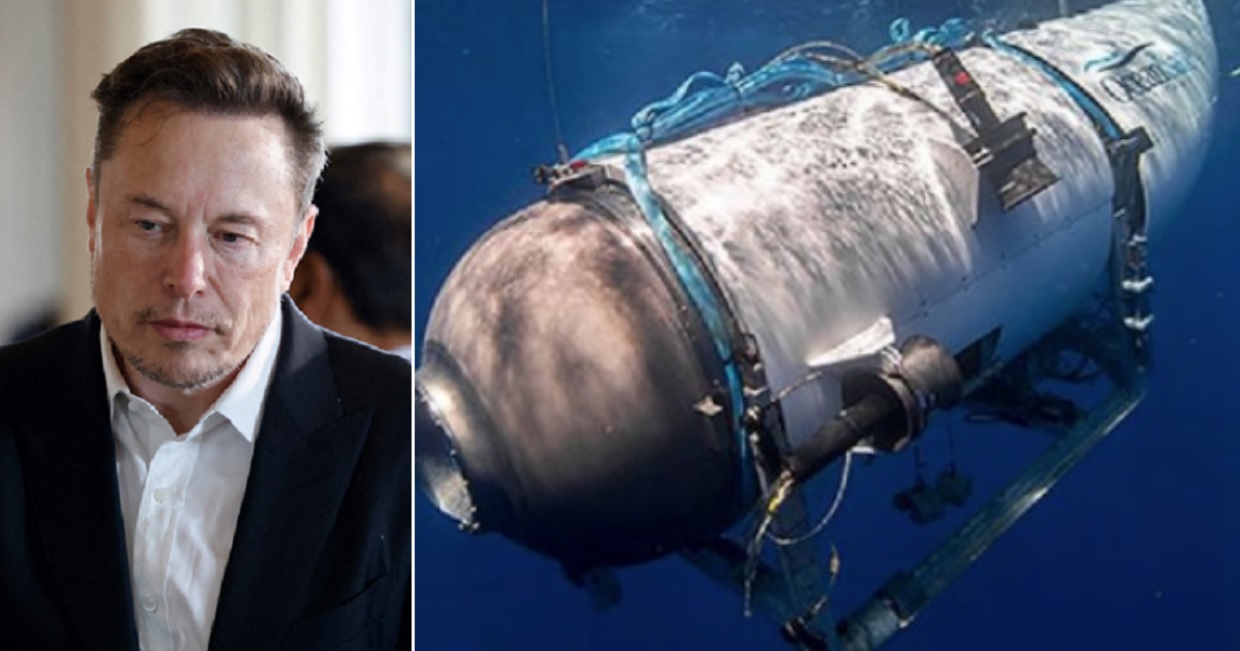

Jury Finds Elon Musk Not Liable in Lawsuit Over 2018 Tweet About Taking Tesla Private

- Tesla CEO Elon Musk was not found liable in a shareholder class action suit. This was stemming out of 2018 tweets in the which he claimed he was thinking about taking Tesla private.

- Tesla shareholders sued the CEO of Tesla, SpaceX, and Twitter over a series tweets he posted in August 2018, saying that he had been fired. “funding secured” To take the automaker private at $420 per share “investor support” Such a deal was “confirmed.”

- Musk later claimed that he had been given a verbal agreement from Saudi Arabia’s sovereign asset fund. He believed that funding would be forthcoming at his suggested price, based on a handshake. The deal did not materialize.

Elon Musk On Friday, a jury in San Francisco found Tesla not liable.https://www.cnbc.com/video/2023/02/03/tesla-and-musk-ruled-not-liable-in-securities-fraud-case-over-tweet.html”>class-action securities fraud trial It stemmed from Musk’s 2018 tweets.

The TeslaSpaceX and Twitter The CEO was Tesla shareholders are being sued A number of Tweets he sent August 2018, he said he had “funding secured” To take the automaker private at $420 per share “investor support” Such a deal was “confirmed.”

Tesla trading was stopped His tweets caused volatility in the stock price for weeks.

The jury deliberated for less time than two hours before they read their verdict. “We are disappointed with the verdict and considering next steps,” Nicholas Porritt (partner at Levi & Korsinsky), the firm that represents the shareholders in this class action, sent an email to CNBC.

“I am deeply appreciative of the jury’s unanimous finding,” Musk Twitter: Posted.

Alex Spiro, Quinn Emanuel Urquhart & Sullivan’s lead counsel for Musk, argued before the jury earlier in the day. He noted that the Tesla CEO was only contemplating taking the company private. He claimed that fraud cannot arise from a consideration.

Spiro didn’t immediately respond to our requests for comment.

A mix of options and stock buyers were included in the class-action lawsuit. They claimed that Musk’s tweets were recklessly false and that they relied on his statements to make important decisions about when to sell or buy.

Musk claimed later that he had verbally committed to Musk Saudi Arabia’s sovereign Wealth FundHe stated that he believed funding would come through at the price he proposed based on a handshake. But the deal never happened.

This trial lasted for approximately two weeks. Musk also stated these words To finance a going private deal for Tesla, he would have also sold SpaceX shares and received funds from Saudi Public Investment Fund.

" Conservative News Daily does not always share or support the views and opinions expressed here; they are just those of the writer."