Janet Yellen Celebrates Controversial ‘Once-In-A-Generation’ Global Minimum Corporate Tax Agreement

On Friday, the Organization for Economic Cooperation and Development (OECD) announced that they had agreed to a global minimum corporate tax rate of 15%, after years of debate and disagreement.

“The landmark deal, agreed by 136 countries and jurisdictions representing more than 90% of global GDP, will also reallocate more than USD 125 billion of profits from around 100 of the world’s largest and most profitable MNEs to countries worldwide, ensuring that these firms pay a fair share of tax wherever they operate and generate profits,” the OECD said in a statement.

136 jurisdictions out of the 140 members of the OECD and G20 “Inclusive Framework on BEPS” joined the “Statement on the Two-Pillar Solution to Address the Tax Challenges Arising from the Digitalization of the Economy.”

“Today’s agreement will make our international tax arrangements fairer and work better,” said OECD Secretary-General Mathias Cormann. “This is a major victory for effective and balanced multilateralism. It is a far-reaching agreement which ensures our international tax system is fit for purpose in a digitalized and globalized world economy. We must now work swiftly and diligently to ensure the effective implementation of this major reform.”

This agreement marks a significant change for smaller economies that, in the past, have relied on lower tax rates to attract larger corporations. Some such countries which were long-term opponents of raising corporate tax rates — such as Ireland and Hungary — were convinced to join after some alterations were made to the original proposal. One such important change was the stipulation that the 15% tax rate would not be increased and that the new rates would not apply to small businesses.

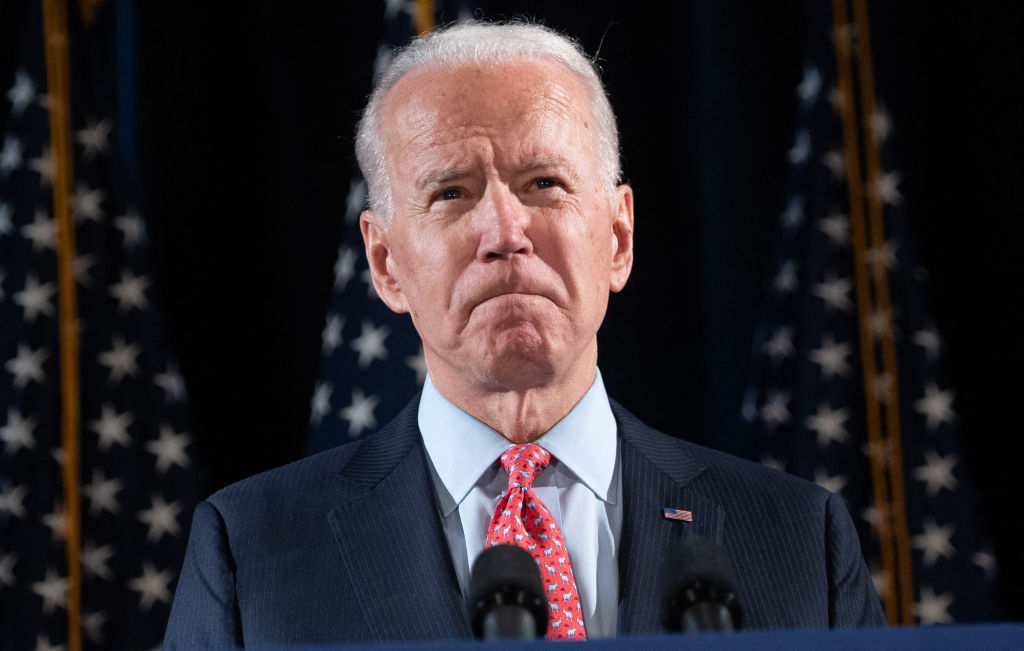

In a statement, Secretary of the Treasury, Janet Yellen, called the agreement a “once-in-a-generation accomplishment for economic diplomacy.”

“We’ve turned tireless negotiations into decades of increased prosperity – for both America and the world,” she wrote. “As of this morning, virtually the entire global economy has decided to end the race to the bottom on corporate taxation. In its place, more than 130 nations — including all 20 in the G20 — have agreed to a new and specific set of provisions to uniformly tax the income of multinational companies, including a global minimum tax. Rather than competing on our ability to offer low corporate rates, America will now compete on the skills of our workers and our capacity to innovate, which is a race we can win.”

“This deal is a victory for American families, who will benefit from the revenues this deal raises to pay for infrastructure, child care, and clean energy; it’s a win for American businesses, which will no longer have to compete on an international playing field tilted against them; it’s a victory for the international business community, which will enjoy a more stable and certain environment, with fewer tax and trade disputes; and it’s a victory for the members of Congress who have drafted their own international tax reform proposals. This deal paves the way for Congress to enact those proposals, and I’m hopeful they’ll do so swiftly through the reconciliation process,” Yellen added. “International tax policymaking is a complex issue, but the arcane language of today’s agreement belies how simple and sweeping the stakes are: when this deal is enacted, Americans will find the global economy a much easier place to land a job, earn a living, or scale a business. President Biden often talks about a ‘foreign policy for the middle class.’ Today is what foreign policymaking for the middle class looks like in practice.”

As CNBC explains, ‘The deal marks a shift in tax policy because it not only imposes a minimum corporate tax rate, but it also forces companies to pay taxes where they operate — not just where they have their headquarters.”

However, “The exact formula for working out how much companies will owe across the various jurisdictions is one detail that still needs to be finalized.”

The Daily Wire is one of America’s fastest-growing conservative media companies and counter-cultural outlets for news, opinion, and entertainment. Get inside access to The Daily Wire by becoming a member.

" Conservative News Daily does not always share or support the views and opinions expressed here; they are just those of the writer."