Democrats Pressure Banks to “Atone for Slavery”

Banks should fund community development in Black communities, support the education of the next several generations of Black students and take other steps to atone for the role they played financing and supporting slavery in America, witnesses told a House committee hearing organized by Democrats on Wednesday.

The House Financial Services Committee held a hearing on “The Role of Financial Institutions in the Horrors of Slavery and the Need for Atonement,” which could be the final hearing led by Chairwoman Maxine Waters, D-Calif., before Republicans take control of the House in January.

William Darity, a professor of public policy at Duke University, said the slave trade was a major contributor to the growth of the U.S. financial sector, and said slavery is why Black families are so far behind White families when it comes to household net worth. Darity said a 2020 study says the average White household net worth is $840,000 higher than net worth for Black families and said bridging that gap would be expensive.

SLAVERY PROHIBITED IN ALABAMA, TENNESSEE, VERMONT, TOO CLOSE TO CALL IN OREGON

The House Financial Services Committee, chaired by Rep. Maxine Waters, D-Calif., held a hearing Wednesday to examine how U.S. banks can atone for their role in slavery.

(AP Photo/J. Scott Applewhite)

“The collective amount required to close the disparity for approximately 40 million black American descendants of persons enslaved in the United States will come to at least $14 trillion,” he said in his written testimony. “This is a sum that cannot be met reasonably by private donors or other levels of government.”

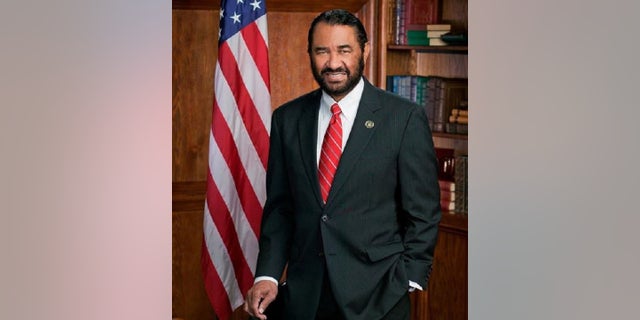

Other witnesses offered ideas on how banks can atone for their participation in the slave trade, which Rep. Al Green, D-Texas, contributed to the vast wealth of U.S. financial institutions that was “built on the backs of enslaved people.”

Dr. Sarah Federman, associate professor at the University of San Diego’s Kroc School of Peace Studies, said financial institutions today still need to answer for their role in slavery.

HAKEEM JEFFRIES, PELOSI’S LIKELY REPLACEMENT, SUPPORTS COMMISSION TO STUDY SLAVERY REPARATIONS

Rep. Al Green, D-Texas, said the wealth of U.S. banks was built on the backs of enslaved people.

(Office of Congressman Al Green)

“We are not pursuing criminal justice, but transitional justice through which institutions differentiate themselves from a prior criminal regime by addressing the harm and committing to ethical behavior going forward,” she said in her testimony. “Most financial institutions that profited from slavery have not done this work.”

“When legacy corporations continue profit from their heritage brand and strength due to ill-gotten gains but do not participate reckoning work, they continue their complicity with the prior regime,” she said.

As a solution, Federman said offering three generations of Black Americans free higher education would be a “major contribution,” along with supporting economic development in Black communities.

Dania Francis, assistant professor of economics at the University of Massachusetts in Boston, said after slavery ended, Black farmers lost farmland that is worth more than $300 billion today. She said financial institutions should fund studies examining the role they played and commit “funding and resources to community development activities in Black communities.”

The hearing might be the last chaired by Rep. Maxine Waters, D-Calif., as Republicans take control of the House in January.

(Sarah Silbiger/Pool via AP)

Lily Roberts, acting vice president of the Inclusive Economy Center for American Progress, said banks should eliminate wage disparities between Black and White workers and create “programs to redress past wrongs.”

CLICK HERE TO GET THE FOX NEWS APP

“Financial institutions are fully capable of learning their own history and understanding their own roles in past injustice,” she said. “Next, they must work to ensure that they counter contemporary wrongs and avoid the easier instinct to think of historical context as separate from current circumstances – and be held accountable in doing so by the federal government, by shareholders, and by customers.”

" Conservative News Daily does not always share or support the views and opinions expressed here; they are just those of the writer."