Congressional Budget Office: ‘Build Back Better Act’ Will Increase Deficit By $367 Billion

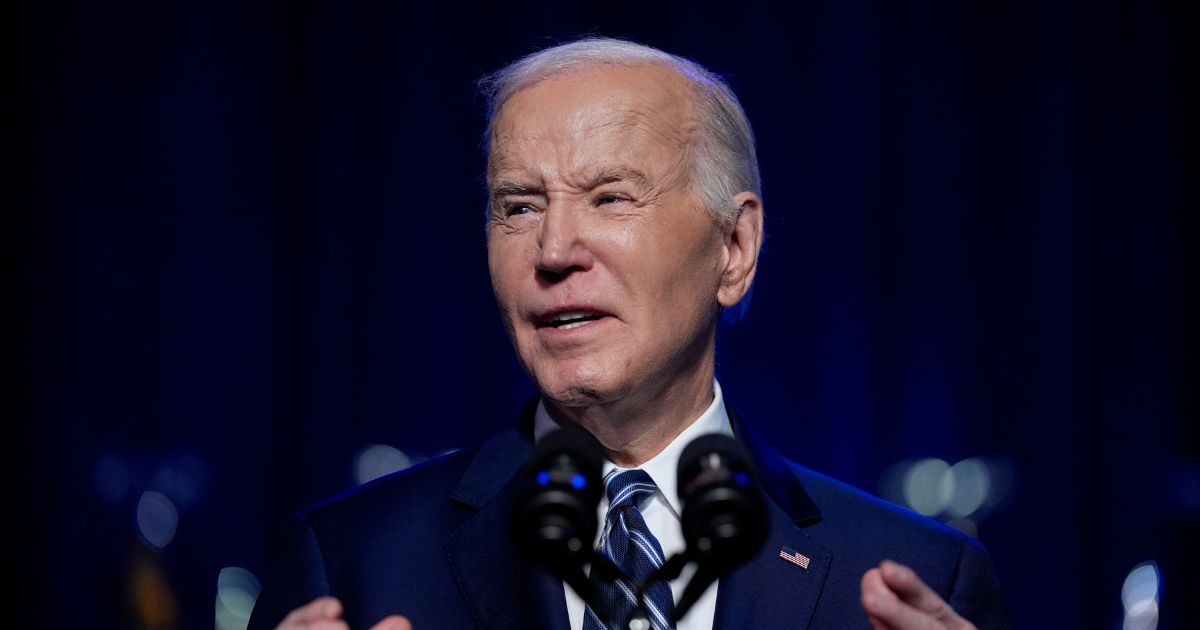

The Congressional Budget Office — the federal government’s nonpartisan fiscal scorekeeper — said that the pending Build Back Better Act would add $367 billion to the deficit by 2031.

The legislation — which the House of Representatives passed on Friday — would spend $1.75 trillion on various social programs, including universal preschool, childcare subsidies, and climate change initiatives. Moderate Democrats were reportedly waiting to support the bill until they could review the Congressional Budget Office’s analysis, which was released Thursday.

The Wall Street Journal explained:

The CBO found that the bill would contribute $367 billion to the deficit over 10 years; Democrats have argued that revenue not captured in the CBO score shows that the bill is more than fully paid for.

For technical reasons, the CBO’s bottom line doesn’t include $207 billion in revenue that the scorekeeper estimates would result from pouring roughly $80 billion into tax-enforcement efforts at the Internal Revenue Service. Adding that revenue to the CBO’s other estimates would make the bill’s 10-year deficit about $160 billion. The Biden administration says its IRS spending would generate $480 billion, not $207 billion; in its view, that would tip the bill over to reducing the deficit, and many Democrats appear willing to accept that perspective.

CBS News adds that Biden administration officials are pleased with the analysis:

Treasury Secretary Janet Yellen welcomed the CBO’s analysis. Noting that the Treasury Department estimates that the crackdown on tax evaders would raise $400 billion, she said in a statement that the combined CBO score, Joint Committee on Taxation estimates and her own department’s analysis “make it clear that Build Back Better is fully paid for, and in fact will reduce our nation’s debt over time by generating more than $2 trillion through reforms that ask the wealthiest Americans and large corporations to pay their fair share.”

A report by the Committee for a Responsible Federal Budget suggests that the true cost of the legislation may be $4.9 trillion due to a number of “arbitrary sunsets and expirations.”

For instance, the bill would extend the American Rescue Plan’s Child Tax Credit increase and Earned Income Tax Credit expansion for a year, set universal pre-K and child care subsidies to expire after six years, make Affordable Care Act expansions available through 2025, and delay the requirement that businesses amortize research and experimentation costs until 2026.

“We estimate extending expiring parts of the Build Back Better Act would cost over $2.5 trillion, increasing

" Conservative News Daily does not always share or support the views and opinions expressed here; they are just those of the writer."