BlackRock shuts China Equity Fund due to Congressional scrutiny.

BlackRock to Close China-Focused Offshore Fund Amid Congressional Scrutiny

BlackRock, the world’s largest money manager, has announced the closure of its China Flexible Equity Fund. The decision comes as the company faces congressional scrutiny over its alleged involvement in directing U.S. dollars to blacklisted Chinese firms.

In a letter to shareholders, BlackRock Global Funds Chairwoman Denise Voss cited a “lack of shareholder interest” and the high investment cost as reasons for the fund’s closure. Voss emphasized that this move is in the best interests of shareholders.

The fund’s assets will be liquidated, and outstanding shares will be redeemed by November 7. Existing shareholders have the option to switch their investments to another fund, sell their shares before the liquidation date, or receive automatic payments when the fund closes.

Related Stories

- How the Biden Admin Is Killing China’s High-Tech Ambitions – 9/7/2023

- G20 Countries Reach Agreement on Joint Statement, Averting Crisis at New Delhi Summit – 9/9/2023

The China Flexible Equity Fund, which was opened in October 2017, had an asset value of approximately $21.4 million as of late August. However, it has experienced negative returns, with a 16.7 percent decline in 2021 and a further drop to 30.5 percent in 2022.

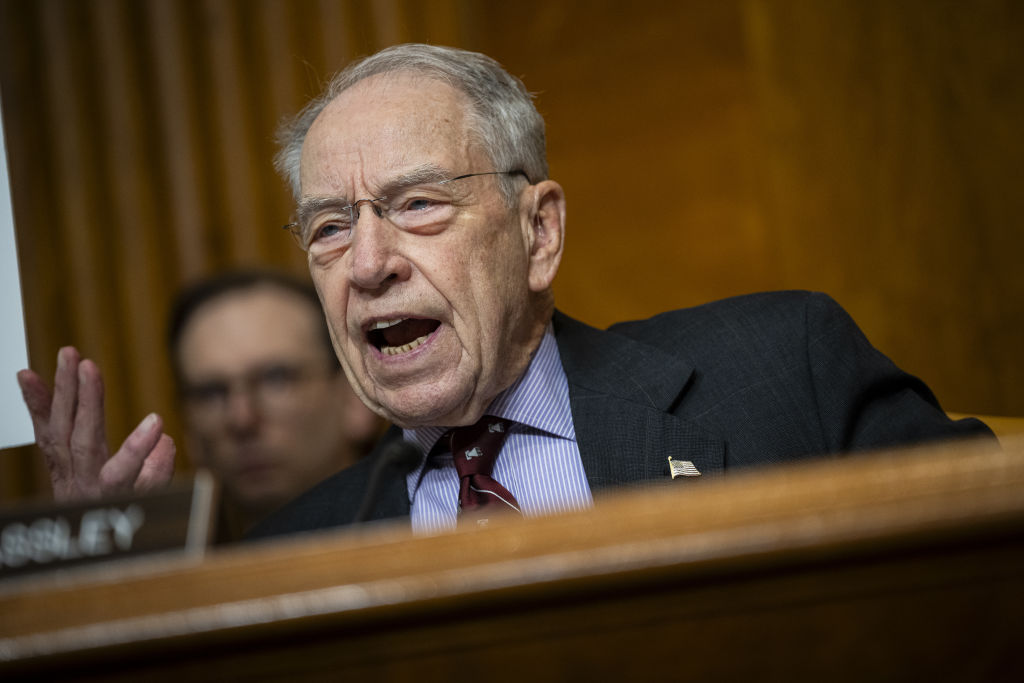

This closure comes shortly after the House Select Committee on the Chinese Communist Party initiated an investigation into BlackRock and investment index provider MSCI for their alleged investments in Chinese companies that the U.S. government considers problematic.

BlackRock and MSCI have facilitated investments in over 60 Chinese entities that have been sanctioned by the U.S. government for national security or human rights issues. The actual number of Chinese companies benefiting from these investments is likely higher. The House committee revealed that BlackRock has invested more than $429 million in such Chinese firms across five funds.

One of the top invested Chinese entities in the China Flexible Equity Fund is Tencent, a state-backed tech giant known for aiding Beijing in silencing dissent and spreading propaganda through its messaging app WeChat. Other notable investments include China Yangtze Power, a state-owned hydropower operator, and Nari Technology, the country’s largest supplier of electric power equipment.

In response to the congressional probe, BlackRock stated that it complies with all applicable U.S. government laws regarding investments in China and markets worldwide. However, the company has not yet commented on the closure of the China fund.

There is a growing wariness among U.S. investors towards the Chinese market. Despite hopes for an economic recovery, China is facing a slowing economy, a drop in trade, a housing crisis, and tensions with the United States.

In August, President Joe Biden signed an executive order restricting U.S. investments in China’s advanced technologies, citing national security risks.

According to Gary Dugan, chief investment officer at Dalma Capital, U.S. investors are particularly concerned about the ongoing trade tensions between the two countries.

China’s regulatory environment also poses challenges for foreign investors. The country has expanded an anti-espionage law that could criminalize regular business activities, conducted raids on foreign companies’ offices, and banned certain purchases from U.S. chipmaker Micron Technology.

Commerce Secretary Gina Raimondo has stated that American businesses increasingly view China as too risky for investment.

Foreign investors have been selling off Chinese stocks, signaling a lack of confidence in the market.

" Conservative News Daily does not always share or support the views and opinions expressed here; they are just those of the writer."