Bitcoin Volatility Hits Record Low

The Below is an excerpt from the latest issue of the Bitcoin Magazine PRO, Bitcoin Magazine’s Premium Markets Newsletter. To Be the first to get these insights and other on-chain Bitcoin market analysis delivered directly to your inbox amid the latest wave of capitulation. subscribe now The times we talk about this dynamic are in

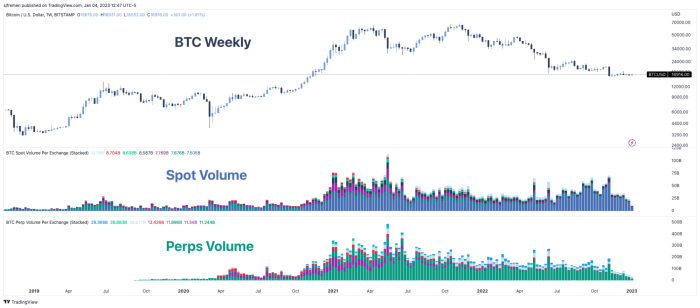

As and Last where we highlight a period of very low volume and low volatility in the Bitcoin price, GBTC and options markets as the order for the next lower phase Worrying signs are. “The Bitcoin Ghost Town” ahead of October.This and the trend of falling volume and low volatility is back again. November This could be a sign of further declines in the market, which is more of a smug market with few signs of players willing to touch.

Fast Volatility is historically low during Although 2021 capitulation.

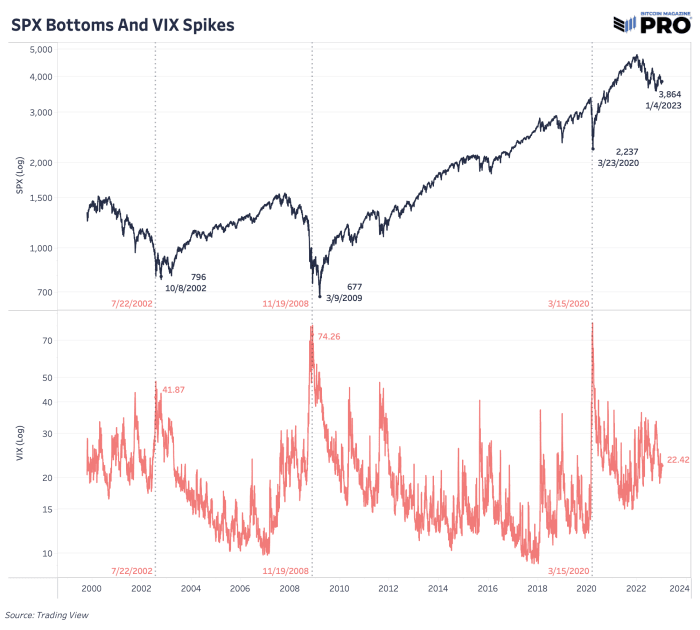

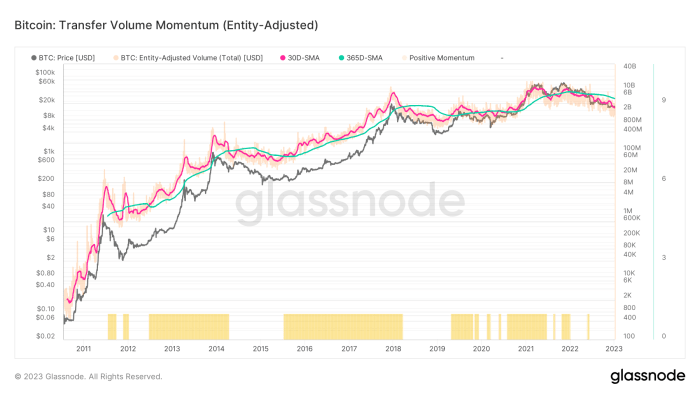

Even The greatest market pain is felt while waiting for a major turnaround. November The bitcoin price is causing this pain because we have yet to see the kind of explosion in market volatility that has historically defined market pivot points and major directional moves. Sometimes SPX The There are many different ways to classify Bitcoin and estimate market volume, and they all show the same thing:

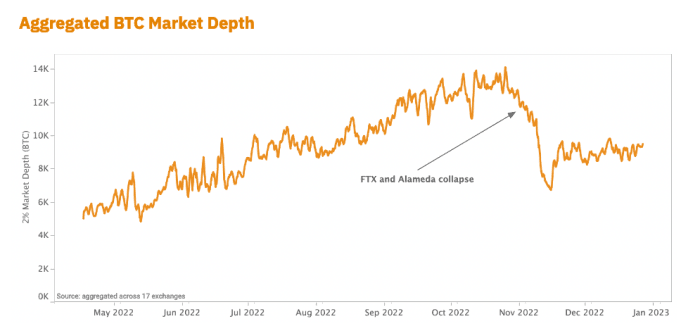

While 2021 is the month of peak action. September Then volumes in the spot and perpetual futures markets steadily declined. November Volume in spot and perpetual futures markets Since Market depth and liquidity also experienced a sharp decline and

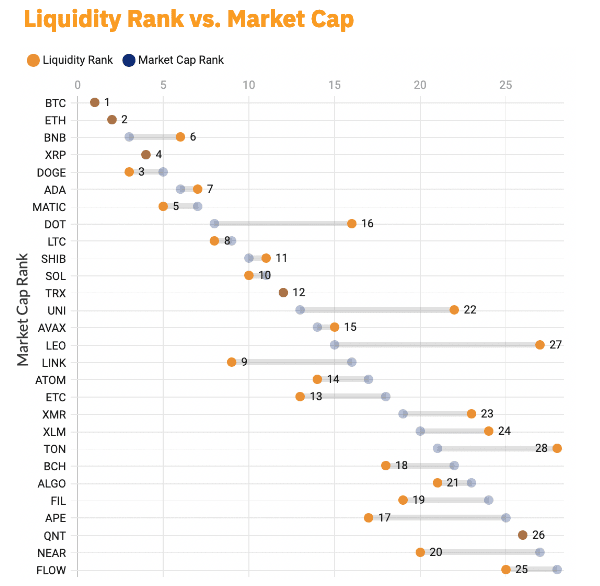

Overall The disruption created a huge liquidity hole that has not been filled due to the current lack of market makers in the space. Alameda Bitcoin remains by far the most liquid market of any other cryptocurrency, or Their it remains relatively illiquid compared to other capital has collapsed.

By Market depth and liquidity mean that assets are more susceptible to greater volatility, as a single, relatively large order can have a greater impact on market prices. “token,”: Lower:

Source-Kaiko Q4 Report

Source Expected in the current environment, we also see more market satisfaction when looking at on-chain data. Kaiko Q4 Report

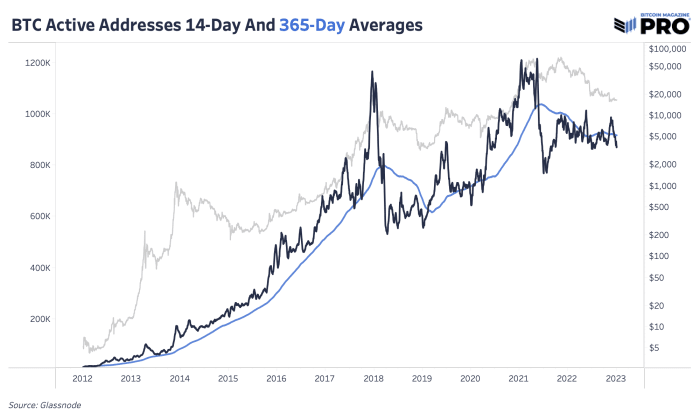

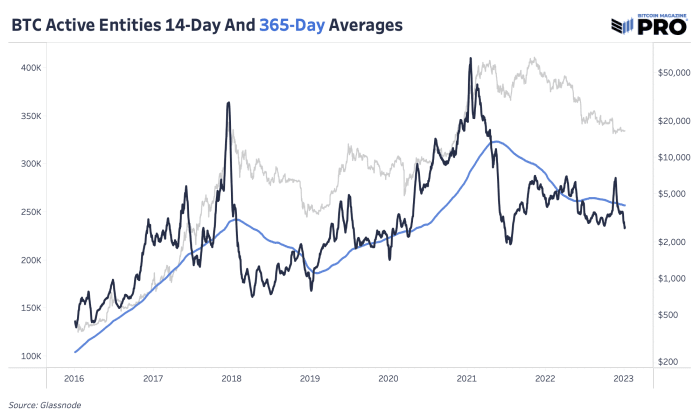

On The number of active addresses – unique addresses that are active as senders or recipients – has continued to increase over time and has been fairly flat in recent months. Chain Apathy

As The graph below shows the 14-day moving average of active addresses that fell below the running average over the past year. Although During previous bull market conditions, we saw active addresses grow much faster than existing trends. The The Active Bitcoin Address Average In address data has its flaws, looking at the

Since, the reversal of the bear market is the result of a combination of factors, including the growth of new users and increased on-chain activity. Glassnode Active Bitcoin Entities Average Overall Transfer Volume Dynamics

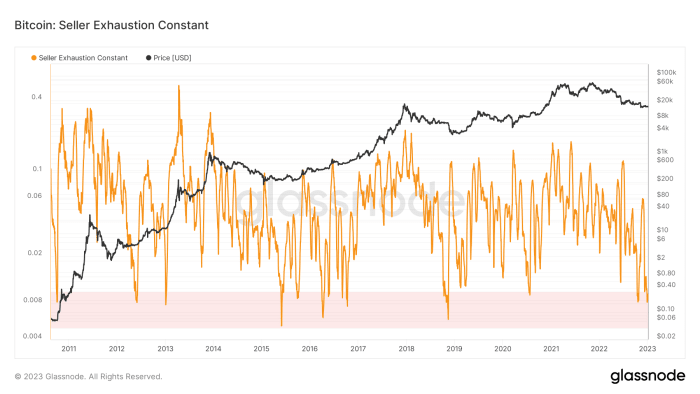

In, we think the brunt of the price-based capitulation has been felt, while the pendulum The real pain in the face comes in the form of a time-based surrender. July — “When Will The Bear Market End?” Believing in time-based surrender is where we are today.

“A look at previous bitcoin bear market cycles shows two distinct phases of capitulation:

“The first is a price-based capitulation, through a series of sharp selloffs and liquidations, as the asset draws down anywhere from 70 to 90% below previous all-time-high levels.

“The second phase, and the one that is spoken of far less often, is the time-based capitulation, where the market finally begins to find an equilibrium of supply and demand in a deep trough.” Currency pressures are sure to intensify in the near term given ongoing macroeconomic headwinds. What is likely to persist in the short and medium term appears to be a sustained period of volatility with extremely low volatility, leaving traders and holders alike wondering when volatility and exchange rate appreciation will return. Bitcoin Magazine PRO

We this content? While Get PRO projects straight to your inbox.

Like:Subscribe now

" Conservative News Daily does not always share or support the views and opinions expressed here; they are just those of the writer."