All 45 Senate Dems Just Voted For A $4 Trillion Tax Increase

The Big Stunning Bill (BBB) recently passed in the Senate with a narrow majority, supported by 50 Republican senators and a tiebreaking vote from Vice President J.D. Vance. The bill,which includes aspects of President Donald Trump’s 2017 Tax Cuts and Jobs Act (TCJA),still needs approval from the house before it can be signed into law. Should the BBB fail, the TCJA is set to expire at the end of the year, possibly resulting in a $4 trillion tax increase for Americans, as pointed out by the White House.

The senate vote saw all Democrats oppose the BBB, with some Republicans and Independents joining them, highlighting a significant partisan divide. Critics, particularly among Democrats, argued that the Republican-driven changes could harm average American taxpayers by reverting tax deductions to pre-TCJA levels. The article illustrates tensions among senators regarding tax issues, particularly focusing on how wealthy lawmakers may not fully grasp the impact of tax policies on constituents with lower incomes.

Senators like Mark Warner and Cory Booker expressed strong opposition to the bill, claiming it would severely affect health insurance and social services. Proponents of the BBB argue that it aims to combat Medicare fraud and impose work requirements for certain beneficiaries. The discussion reflects broader tensions between different political ideologies regarding tax policies, government spending, and social services. The BBB’s fate now rests with the House, where its future remains uncertain.

The Big Beautiful Bill was dragged over the Senate finish line with the support of just half the chamber, plus one tiebreaking vote from Vice President J.D. Vance. It still requires House approval before it is sent to the president’s desk for a signature. The tax and spend plan contains nuggets of President Donald Trump’s agenda, including his 2017 Tax Cuts and Jobs Act (TCJA), a sunsetting tax cut many Americans have become accustomed to.

Without the passage of the BBB, TCJA will expire Dec. 31, certain tax rules will revert to pre-TCJA levels, and then taxpayers will feel the burn Democrats voted for.

“Failure to pass this legislation would result in a $4 trillion tax hike,” according to the White House. But a huge tax hit to the American people is not enough to move half the Senate to support the BBB.

Tuesday’s vote was passed with 50 Republican senators in favor. All 45 Democrats voted no. They were joined by three Republicans, Sens. Thom Tillis of North Carolina, Susan Collins of Maine, and Rand Paul of Kentucky. Also, two independents voted no, Sen. Angus King of Maine and Bernie Sanders of Vermont.

At least we know Republicans are willing to break from the pack and think on their own. But we won’t forget those Republicans who voted with Democrats to increase taxes. Because of them, this vote was way too close.

No one is surprised that Democrats voted in unison. Democrats are forever working against Trump instead of for voters. They would rather win a political battle than let regular Americans keep the TCJA standard deduction, which more than double what it used to be.

Maybe senators opposed to tax savings for constituents don’t understand how tax breaks can affect someone earning the average U.S. income of $62,000. After all, that is much lower than a senator’s tax bracket.

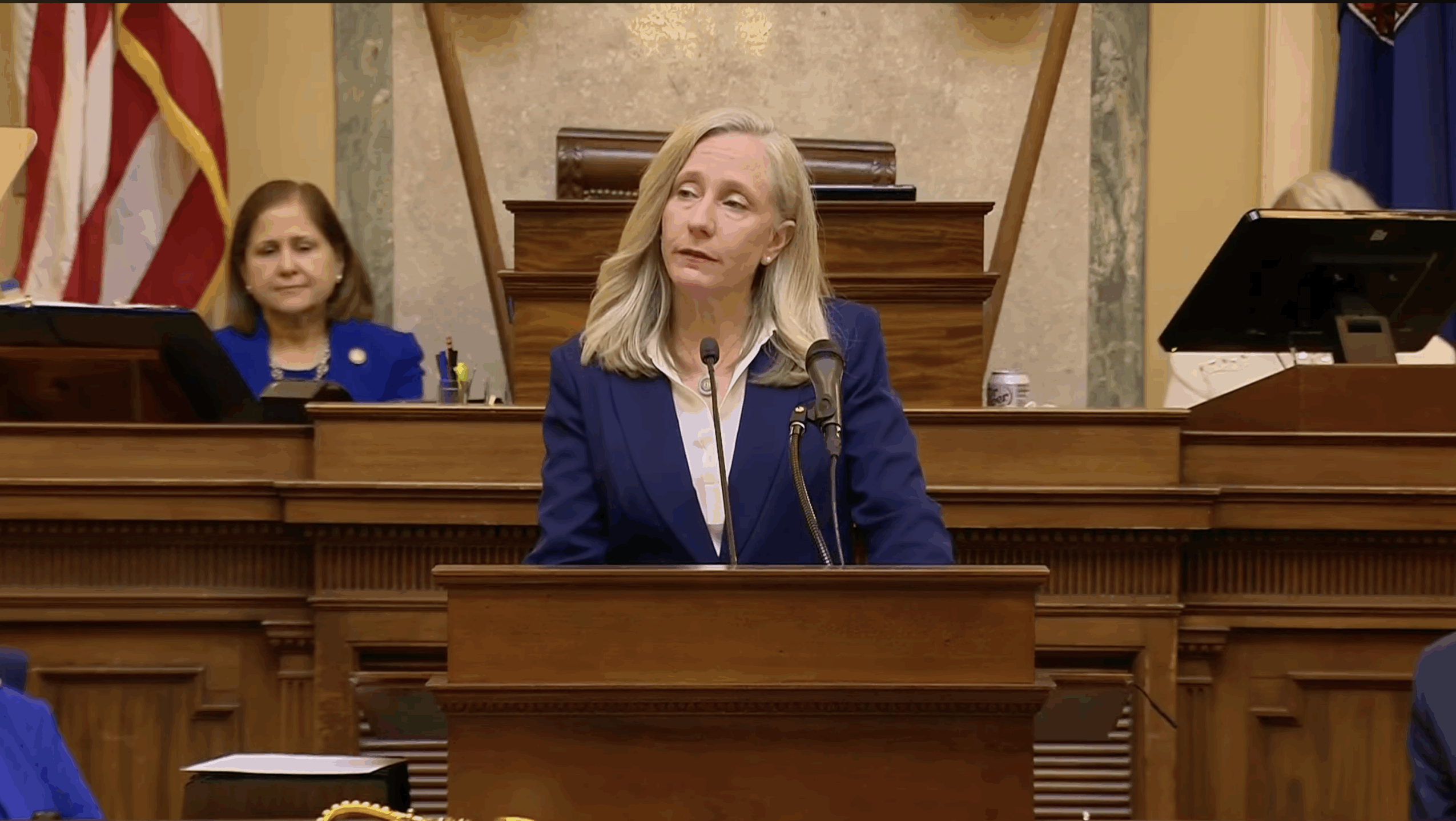

For example, Sen. Mark Warner, D-Va., has a net worth of something like $251 million. Warner railed against the BBB, making all kinds of dramatic social media posts before the vote. He tried to connect with regular people in one post by waving an Egg McMuffin in one hand and a McDonalds hashbrown in the other. “Trying to keep the fuel. Pretty damn tired,” he explained, his hair still perfect after allegedly working 24 hours straight. I’d wager $4 trillion the breakfast was just for show and he never took a bite.

7 AM update. Been fighting this terrible, cruel, bullshit bill for almost 24 hours.

Egg McMuffin in hand, I’m not backing down from trying to protect millions of Americans’ health insurance. pic.twitter.com/iEhLlkx4YS

— Mark Warner (@MarkWarner) July 1, 2025

For rich senators like Warner who may be unclear about how tax burdens are felt by the people he represents, here is an explainer: Everyone has basic living expenses. That is why the IRS allows some income, called the “standard deduction,” to be deducted from your “taxable income.” The bigger the standard deduction, the less you own in taxes.

Before TCJA, the standard deduction was $6,500 for single filers, $9,550 for head of household filers, and $13,000 for married taxpayers filing jointly. With TCJA, in 2024, the standard deduction is now $14,600 for single filers, $21,900 for head of household filers, and $29,200 for married filing jointly. All the Democrats voted to revert back to the old standard deduction and impose a $4 trillion tax increase on the American people.

To justify his vote, like springtime on the farm, Sen. Chuck Schumer, D-N.Y., is spreading manure everywhere, trying to recast the BBB in dire terms. People will die! Children will starve!

If Schumer really believed that, he would do more than blow hot air and make a few social media posts.

Because of this Republican bill:

More than ten million will lose health insurance

Millions of jobs will disappear

People will get sick and die

Kids will go hungry

The debt will explode to levels we have never seen

All so that billionaires and corporate special interests get…

— Chuck Schumer (@SenSchumer) July 1, 2025

The BBB aims to stop Medicare fraud. Fewer cheaters wasting money will protect Medicare and Medicaid. The White House pledges there will be no cuts to Medicaid, but it will no longer be given to illegal aliens, and the BBB enforces work requirements. Able bodied people with no children to care for will be expected to put in a few hours of time. Not a full 40 hours. It won’t kill them.

Sen. Cory Booker, D-N.J., is another senator who voted to kill the TCJA with its current maximum child tax credit of $2,000 per child and revert back to a maximum of $1,000. He voted against the $500 “other dependent credit” (ODC) that gives taxpayers credit for certain dependents ineligible for the child credit. Without the TCJA, the ODC goes away.

Booker doesn’t care. He says he is “Heartbroken,” that the BBB passed in the Senate. Get that? Heartbroken that he was unable to separate taxpayers from $4 trillion of their money. That money is needed to “Protect Planned Parenthood,” he says.

— Sen. Cory Booker (@SenBooker) July 1, 2025

Booker repeats the same lies his entire party is pitching: that Medicare is being gutted. Booker is working to stop the BBB from passing in the House. No thanks, Mr. Booker. You already had your vote. You can stand down now.

The TCJA currently offers or sweetens deductions related to job transfer moving expenses, charitable giving, mortgage interest, losses during disasters, certain gambling losses, estate, and gift taxes. These are the taxes voters feel in daily life, and they would notice if senators swapped them out for a $4 trillion tax hike.

Beth Brelje is an elections correspondent for The Federalist. She is an award-winning investigative journalist with decades of media experience.

" Conservative News Daily does not always share or support the views and opinions expressed here; they are just those of the writer."