Price limits harm individuals.

Why Senator Hawley’s Credit Card Interest Rate Bill is a Bad Idea

Senator Josh Hawley (R-Mo.) recently introduced a bill that would limit the interest rate credit card issuers can charge at 18 percent. This is populism and not well-thought-out policy. Many other populist policies are popular, but their real effect isn’t what was advertised. Mr. Hawley’s idea also is terrible economically and will hurt the people it is designed to help. The senator is a conservative firebrand, but this policy shows they didn’t teach Microeconomics 101 in law school. He has been admirable in drawing attention to and speaking out on many issues—but he missed the mark badly on this one.

For context, why is 18 percent the ceiling? Why not the prime rate? Why not Sen. Bernie Sanders’s idea of a 15 percent cap?

Related Stories

Demand curves always have negative slope. The less you charge for something, the higher the demand will be. Just because demand is there doesn’t mean suppliers will fill the gap at the capped price. There are marginal costs to production, and if the marginal revenue isn’t at least equal to or greater than the marginal cost to produce one more, demand goes unfilled.

In a normal free and unfettered market, the price would increase. The ceiling doesn’t allow that to happen.

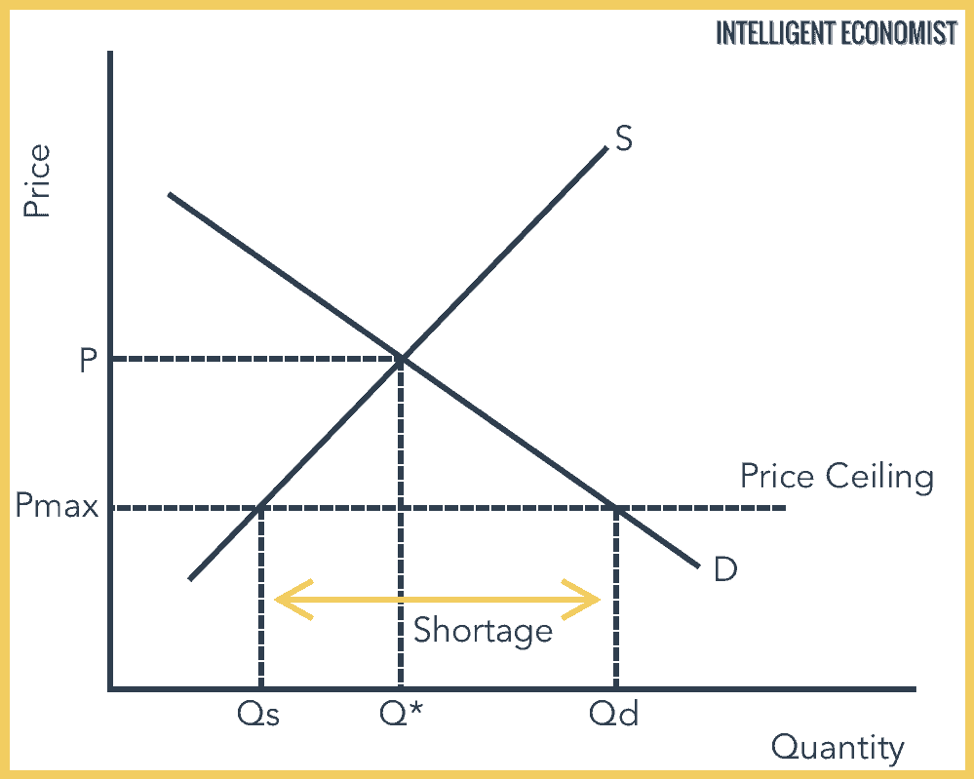

We saw and are experiencing the same economic logic with the Inflation Reduction Act. The Democrats capped the price companies could charge for many drugs, and now it’s tougher to get those drugs. Price caps create shortages since supply gets mismatched with demand. Below is what it looks like graphically. With the price ceiling, the quantity demanded (Qd) artificially grows, and the quantity supplied (Qs) sits at the demand level associated with that price. The Inflation Reduction Act has done absolutely nothing to curb inflation.

What would the effects of the Hawley price ceiling be? Fewer people would get access to credit and most probably they would be poor and lower middle class. They might need access to that credit in order to get things they need while they wait for their wage payment.

You might think to yourself, “Well, those poor people shouldn’t be using credit anyway because it is bad for their financial health.” That invites the slippery slope of government into your own personal finances. Maybe you are doing things that aren’t exactly textbook when it comes to your own financial health. Do you want government regulating what you can do with your own money you earn?

(Source: Intelligent Economist)

There are very few government officials that actually buy into classical economic theory. They love to trot out or pillory economists Milton Friedman or Thomas Sowell when it works for their political point. They even talk a good game when it comes to “supply-side economics.” However, most government officials are focused on the demand curve when it comes to economics. When they question Federal Reserve officials or economists, it’s from the demand perspective.

As anyone who is serious about economics knows, demand is hard to predict and control. There is a lot of variability in demand. That’s why when you go to university business schools, there are zero programs in how to set up and administer a “demand chain.” However, there are plenty of programs designed to administer a “supply chain.”

" Conservative News Daily does not always share or support the views and opinions expressed here; they are just those of the writer."