New York Gov. Kathy Hochul Copies One of Trump’s Signature Policies

New York Gov. Kathy Hochul,who is running for re-election,announced a proposal to eliminate state income tax on tips beginning in the 2027 fiscal year,aligning New York with a federal provision that excludes gratuity income up to $25,000. The move follows recent state actions she signed reducing the middle‑class income tax rate slightly and substantially expanding the child tax credit. The policy mirrors a popular component of former President Trump’s tax package and has drawn praise from some Republicans while critics and some restaurant workers previously criticized Hochul for not adopting the change sooner. Nassau County Executive Bruce Blakeman,a GOP challenger,publicly noted her shift.The story also highlights discussions within Hochul’s administration about possible tax increases on high earners or businesses to help fund new city initiatives, despite her earlier statements opposing income tax hikes; New York’s top marginal rate is among the nation’s highest. The announcement appears shaped by both political pressure and the broader debate over state tax competitiveness.

Democratic New York Gov. Kathy Hochul announced Thursday that she will be following suit with one of President Donald Trump’s signature policy initiatives.

“I’m kicking the new year off with a proposal of no state income tax on tips, continuing my efforts to make New York more affordable for hard-working New Yorkers,” Hochul said in a news release.

The governor, who is seeking re-election in November, signed legislation last year lowering the income tax on middle-class taxpayers 0.1 percent and boosting the child tax credit up to $1,000 per child for those under 4, and up to $500 per child for those 4 to 16.

“This latest expansion marked the largest increase in the credit’s history, significantly surpassing the previous maximum of $330 per child,” Hochul’s office said.

No tax on tips, income tax cuts, and an expansion of the child tax credit were all part of the Republicans’ Big Beautiful Bill, which Trump signed into law in July.

Hochul’s no-tax-on-tips provision for the 2027 fiscal year eliminates liability on gratuity income received up to $25,000, matching federal law.

The New York Post reported, “Republicans have whacked blue states like New York, Illinois, and California for not moving to make sure state income taxes were also eliminated starting this year.”

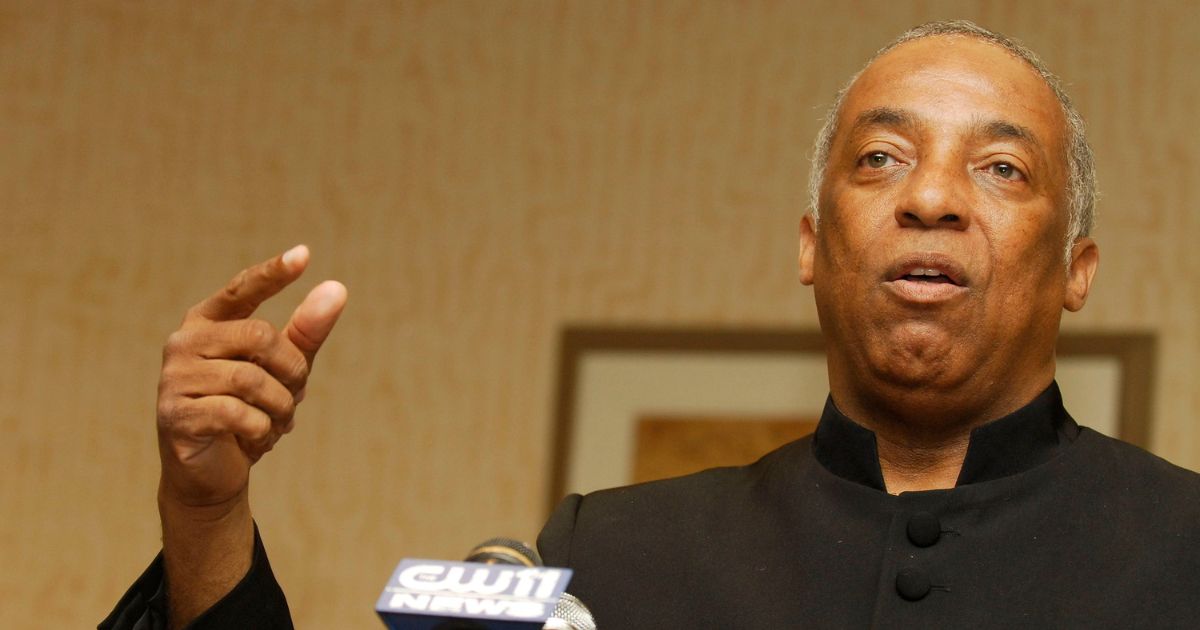

Nassau County Executive Bruce Blakeman, a Republican running to unseat Hochul, responded to her decision, telling the Post, “I see Kathy Hochul is doing a U-turn on taxing tips. I was told she changed her mind after I said I would never tax tips.

“Kathy, if you want more of my ‘tips’ on how to govern, just continue to follow my lead,” he added.

I didn’t grow up in politics.

I worked tip-based and blue-collar jobs.

I know money is earned.That’s why I’m fighting for no tax on tips. pic.twitter.com/gLMpdC8Ueh

— Bruce Blakeman (@NassauExec) December 30, 2025

Like Hochul, Democratic 2024 presidential nominee Kamala Harris came out in support of no tax on tips during the campaign after Trump’s proposal proved popular among service industry employees, including in the swing state of Nevada.

The issue was shaping up to be a big one for Hochul’s re-election bid, as multiple restaurant workers expressed anger toward the governor for not following the president’s lead. New York has among the highest taxes in the country.

“It’s disgraceful. People live off of tips,” Zoe Kalodimos, 30, a waitress at Embassy Diner in Bethpage, Long Island, told the New York Post.

“For [Hochul] to do that is just, it’s disheartening. It’s upsetting,” she added.

Kalodimos said she loses up to $1,000 a month in take-home pay due to taxes from tips, and she was looking forward to Trump’s policy applying at the state level, too.

🚨SHAMEFUL: Kathy Hochul REFUSES to extend Trump’s “No Tax on Tips” to state taxes, infuriating NY service workers who VOTED for Trump because of this iconic legislation: “It’s disgraceful”

Democrats are always there to screw the working class over, while acting like they care… pic.twitter.com/a1c8Dmu4Pi

— 𝙏𝙝𝙚 𝙂𝙤𝙡𝙙𝙚𝙣 𝘼𝙜𝙚 𝙏𝙞𝙢𝙚𝙨 🇺🇸 (@GoldenAgeTimes2) December 27, 2025

“It’s like losing money,” she said. “So it’s hard, especially when everything’s so expensive in life right now. That’s my livelihood, that’s how I eat and feed myself and my family.”

While Hochul has finally boarded the “no tax on tips” train, she may have reversed course on whether she would support newly sworn-in Mayor Zohran Mamdani raising taxes on the wealthier New York City residents.

Before his election in June, she told reporters, “I have said that I will not raise income taxes on the people of our state. I’m focused on affordability, and raising taxes on anyone does not accomplish that. I’m just making sure that people who create jobs will stay here so we can have good-paying jobs.”

But after Mamdani’s victory in November, Politico reported that Hochul and her advisers had been mulling over how exactly to help fund his grand plans, and one possibility they discussed was raising taxes on higher-income individuals and companies.

New York State already has one of the highest income tax rates in the nation for upper-tier earners at 10.9 percent. The tax rate for middle-class taxpayers, making between approximately $14,000 and $80,000, is 5.5 percent.

Several states, including Florida, Texas, Tennessee, and New Hampshire, have no state income tax at all.

Advertise with The Western Journal and reach millions of highly engaged readers, while supporting our work. Advertise Today.

" Conservative News Daily does not always share or support the views and opinions expressed here; they are just those of the writer."