GOP ‘big, beautiful bill’ passes out of House Rules Committee

The House Rules Committee has advanced the “One Big Lovely Bill Act” after extensive debates, with a crucial vote set for the full House. The legislation received a narrow approval of 7-6, with two Republicans voting against it alongside Democrats, based on concerns regarding its fiscal implications. Critics, including Reps. Chip Roy and Ralph Norman, argue that the bill deviates from prior agreements on spending and tax cuts, predicting it could add significantly to the national deficit.

Key details emerging from the legislation include projected increases to the deficit by $3.3 trillion over a decade and changes to taxation that may concern different factions within the party. potential challenges ahead include gaining support from both conservative and centrist Republicans who are worried about cuts to Medicaid and other fiscal policies.

House Speaker Mike Johnson acknowledges the challenges in rallying party support and emphasizes a commitment to addressing concerns about the bill. The bill is seen as critical for providing a political win for President Trump ahead of Independence Day, but its passage hinges on prosperous negotiations among party members. The timeline for voting is tight, with officials aiming to meet the self-imposed July 4 deadline.

Trump’s ‘Big, Beautiful Bill’ passes out of House Rules Committee with roadblocks ahead

The House Rules Committee advanced the One Big Beautiful Bill Act early Wednesday morning after hours of debate, with a long day ahead for Republicans as they try to pass the legislation before the self-imposed deadline of July 4.

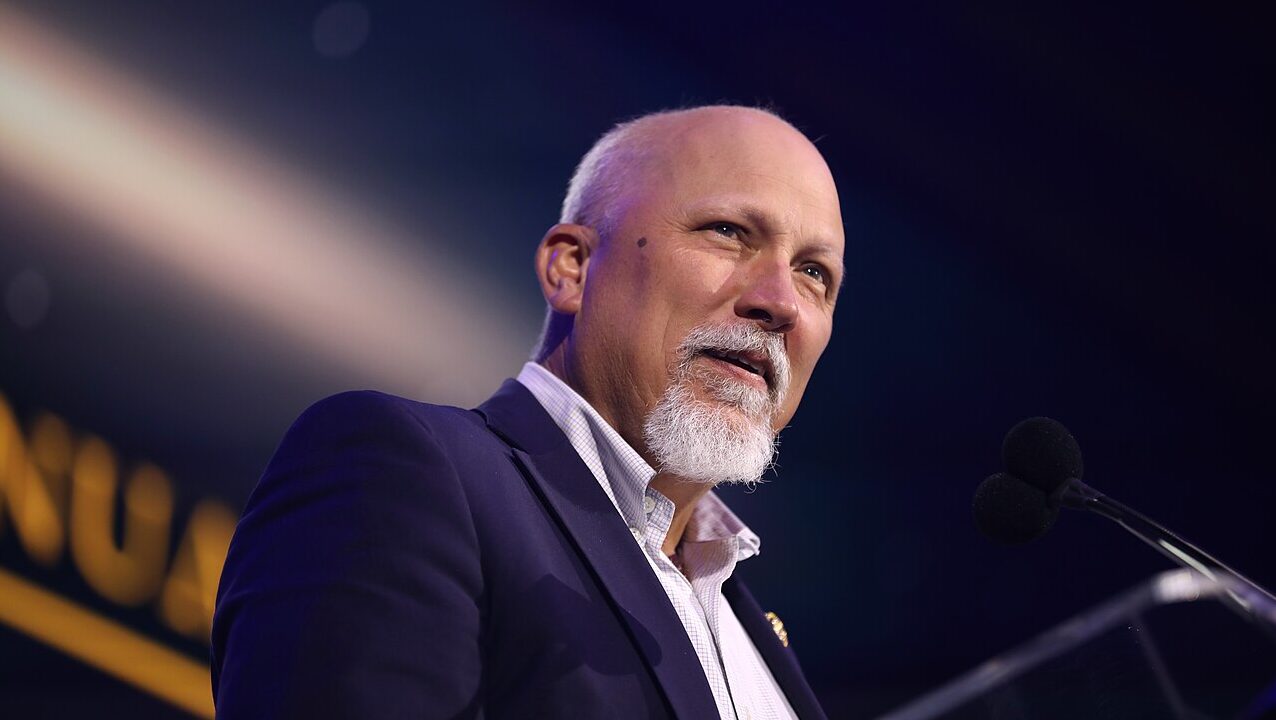

The committee approved a rule for the tax and spending legislation in 7 to 6 vote, with two Republicans joining with all Democrats in opposition: Reps. Chip Roy (R-TX) and Ralph Norman (R-SC). Norman and Roy’s “no” votes were expected, as the fiscal hawks have blasted the Senate for deviating from the legislation’s language that narrowly passed the House in May.

TRUMP’S ‘BIG, BEAUTIFUL’ TAX BILL CLEARS SENATE AFTER GOP REBELLION FORCES VANCE TIEBREAKER

The legislation now heads to the floor, where members have been told per a whip notice that they could expect votes beginning as early as 9 a.m. on Wednesday. If the procedural rule vote passes the full chamber, then the legislation would likely sail to final passage just in time to deliver President Donald Trump an Independence Day political victory.

Heading into the Rules Committee meeting that lasted about 12 hours, Norman said he thought the bill was a “nonstarter.”

“What we ought to do is take exactly the House bill that we sent over and go home and say, ‘When you’re serious, come back,’” Norman told reporters. “That’s my message. Send the House bill back. When they’re serious, come back to us.”

Roy told reporters ahead of the committee hearing that he needed to study the bill and understand the deal that was struck to get Sen. Lisa Murkowski (R-AK) to vote “yes” on the legislation earlier that day.

“I got to go see the language to know what’s being reported,” Roy said. “But the overall deficit number is not good.”

The Congressional Budget Office said the Senate version will add some $3.3 trillion to deficits over the next decade, which the House Freedom Caucus said violates the cost-cutting agreements in the budget framework, and raises the debt ceiling by $5 trillion.

Notably, the CBO’s $3.3 trillion number doesn’t measure the bill against current policy. Rather, CBO assumes Congress would have allowed for a $4.5 trillion tax increase by letting Trump’s 2017 tax cuts expire at the end of this year.

When using the current policy baseline, the CBO found the legislation would reduce the deficit by $508 billion.

“I don’t believe this delivers what the president, what the administration, were working to deliver on,” Roy said.

After passing out of the Rules Committee, the legislation’s fate now lies in the hands of Speaker Mike Johnson (R-LA) and other House GOP leaders to try and whip enough support to push the legislation over the finish line.

Johnson told reporters as he walked into the Rules Committee meeting that he’s “not happy with what the Senate did to our product.”

But, he said, “we understand this is a process that goes back and forth, and we’ll be working to get all of our members to yes.”

House Republican sources told reporters on a press call Tuesday that the bill is 85%-90% of the original House bill and has Trump’s full support. The sources acknowledged that the bill is more conservative in some places and more centrist in others, but the House is moving forward to consider the bill and get it to the president by Friday.

Sources said the bill is in a “legislative sweet spot.” If they continue to go back and forth and it doesn’t pass, the sources said it could lead to consequences for the country, such as a tax hike.

Procedural rule votes have been weaponized in recent months by fiscal hawks to try and force leadership to come to the table and make a deal. Eyes will be on the Freedom Caucus and its like-minded allies to see whether they will hold up the floor and withhold a vote until they hear a compromise that suits their demands.

Leadership will also need to gain support from centrists who have expressed concerns with the Senate’s changes to Medicaid. Alterations to the provider tax, which the states use to help fund Medicaid, were slashed from 6% to 3.5% in the Senate’s version. The House’s version froze it. The provision led Sen. Thom Tillis (R-NC) to oppose the bill, and many other senators had threatened to withhold their support until concessions were made.

It’s likely the provider tax changes will be a sticking point with Medicaid centrist lawmakers, with many like Reps. David Valadao (R-CA) and Don Bacon (R-NE) stating they would vote no or would lean toward no if Medicaid cuts were too steep.

Johnson acknowledged that his members, both conservatives and centrists, were hoping the Senate version would make the reconciliation text better, not worse.

“Welcome to Congress,” the speaker said when asked for a reaction to that. “It’s a disappointing job sometimes, OK, we’re working on it.”

One bloc Johnson may not need to sway over as much are those in the SALT Caucus, after the Senate maintained the House’s $40,000 cap on state and local tax deductions. The cap, however, only lasts five years before reverting to the current $10,000 limit — a catch that could put Republicans like Reps. Mike Lawler (R-NY) or Nick LaLota (R-NY) on the fence.

LaLota said last week he was against the SALT deal that sunsets the $40,000 cap after five years. But on Tuesday, he said he was reviewing the Senate’s bill and gave an “early analysis” that middle-class families in his district would see a $6,000-plus federal tax cut — “$5K from the higher $40K SALT deduction.”

If the House makes any changes to the bill, it would have to go back to the Senate. Murkowski told reporters after passage that she wants the House to send the legislation back to the upper chamber.

”My hope is that the House is gonna look at this and recognize that we’re not there yet,” Murkowski said, adding that if she voted against the bill, it would have killed it.

THOM TILLIS ANNOUNCES RETIREMENT AFTER OPPOSING TRUMP TAX BILL

“Kill it and it’s gone,” Murkowski added. “There is a tax impact coming forward. That’s gonna hurt the people in my state.”

Trump is adamant that the House is on schedule, stating in a Truth Social post that he is confident the Fourth of July deadline can be met. When asked if the self-imposed deadline is realistic, Johnson said, “We’ll see what happens in the next 24 hours.”

" Conservative News Daily does not always share or support the views and opinions expressed here; they are just those of the writer."