Goldman Sachs Cuts U.S. Growth Forecast, Says Recession Odds as High as 35%

The U.S. stock market put in a resilient performance on Thursday, given the data showing inflation surging to a new 40-year high even before the impact of the recent sanctions on Russia, what appeared to be a pretty dismal result from the Russian-Ukrainian meeting of foreign ministers in Turkey, and a surprisingly hawkish decision by the European Central Bank.

Besides the humanitarian catastrophe, sky-high commodities prices have been the result so far of what has been a two-week invasion. Economists at Goldman Sachs have now cut their forecast for growth for the world’s largest economy in 2022 to 1.75%, from 2% previously and the consensus of 2.75%.

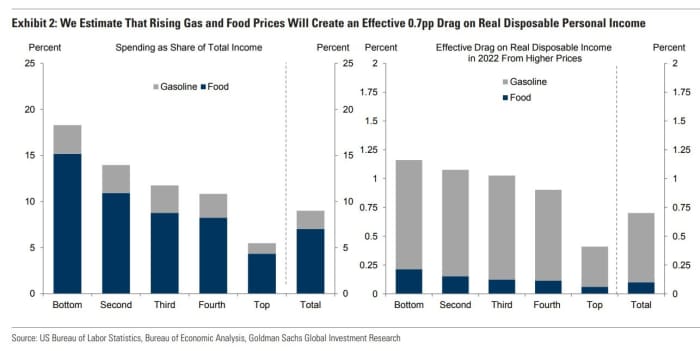

It’s a pretty straightforward call. “Combining our commodity strategists’ forecasts with estimates of pass-through to consumer prices, we estimate that rising gas and food prices will create an effective 0.7 percent point drag on real disposable personal income in 2022 with larger drags for lower-income households whose spending is typically more sensitive to fluctuations in income,” said the note written by Joseph Briggs. “Although households will likely partially offset this income drag by reducing savings, this hit to income should weigh on spending in 2022.”

Besides commodity prices, the Goldman team also noted that consumer sentiment tends to be affected by geopolitical crises, and already gauges from Morning Consult and Ipsos have dropped. The downgrade to Europe’s growth prospects will hit U.S. exports, and a tightening of financial conditions will also weigh on U.S. growth.

The Goldman team said, if anything, they may be too positive on the outlook for the U.S. economy. “Even after these downgrades, we still see risks around our growth forecast as skewed to the downside, particularly if sanctions escalate or if oil prices rise even further, for example, to the $175/barrel price target our commodity strategists see as possible if supply losses reach four million barrels a day. Additionally, we have not assumed any growth hit due to metal shortages since—aside from palladium—only a small share of U.S. commodity demand is met by Russian exports,” said Briggs.

Recession risks, they said, are mounting. While they expect further service-sector reopening and spending from excess savings to keep the U.S. economy growing, they said the chances of a recession next year are between 20% and 35%, or roughly as implied by the slope of the U.S. Treasury yield curve.

The chart

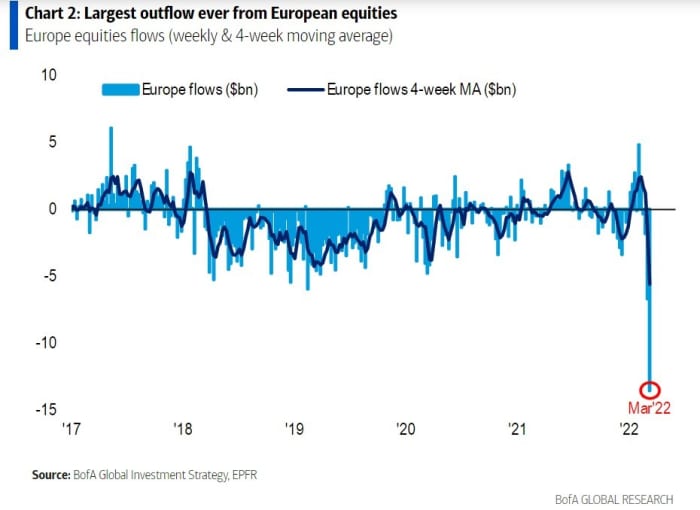

It wasn’t that long ago when European stocks were the trendy call for 2022, on the logic that the region would benefit from the NextGenerationEU spending and a later recovery from COVID-19 than the U.S. Investors aren’t sharing that view now, with the largest-ever retreat from European equities on record.

The buzz

Attention is back on Russia and Ukraine heading into the weekend. Russian President Vladimir Putin was quoted as saying there were “certain positive shifts” from Ukraine, news that sent stock futures higher. Russia on Friday struck military bases in western Ukraine and claimed to have 16,000 volunteer fighters from the Middle East.

U.S. and European allies were set to revoke “most favored nation” trading status for Russia, as Russia announced an export ban on more than 200 products, ranging from medical equipment to locomotives.

China ordered a COVID-19 lockdown of the nine million residents of the northeastern city of Changchun.

DocuSign

DOCU,

-20.10%

shares skidded 17% in after-hours action, after the online signature company issued guidance on bookings and revenue below Wall Street estimates.

Rivian Automotive

RIVN,

-7.56%

slumped as the electric-truck maker cut production guidance.

Educational publisher Pearson

PSO,

+17.72%

surged in London trade after Apollo Global Management said it may make an offer for the company.

The University of Michigan’s consumer sentiment index is due for release at 10 a.m. Eastern.

The markets

U.S. stock futures

ES00,

+0.10%

NQ00,

+0.10%

surged following the Putin remarks. The yield on the 10-year Treasury

TMUBMUSD10Y,

1.997%

reclaimed the 2% mark, and oil

CL.1,

-0.22%

futures traded lower.

Top tickers

Here were the most active stock-market tickers as of 6 a.m. Eastern.

| Ticker | Security name |

|

TSLA, -5.12% |

Tesla |

|

GME, -7.83% |

GameStop |

|

AMC, -6.66% |

AMC Entertainment |

|

NIO, -9.57% |

Nio |

|

AMZN, -0.88% |

Amazon.com |

|

AAPL, -2.39% |

Apple |

|

BABA, -6.68% |

Alibaba |

|

RIVN, -7.56% |

Rivian Automotive |

|

CEI, -14.27% |

Camber Energy |

|

MULN, +26.17% |

Mullen Automotive |

Random reads

Read the sarcastic letter from Ukraine thanking Russia for corruption in the military.

The actor Jussie Smollett was sentenced to 150 days in jail for lying about a fake hate crime.

The musician Grimes and Tesla CEO Elon Musk picked another unusual name for their second child.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.

" Conservative News Daily does not always share or support the views and opinions expressed here; they are just those of the writer."