Fed officials worried about ending inflation battle prematurely, minutes show

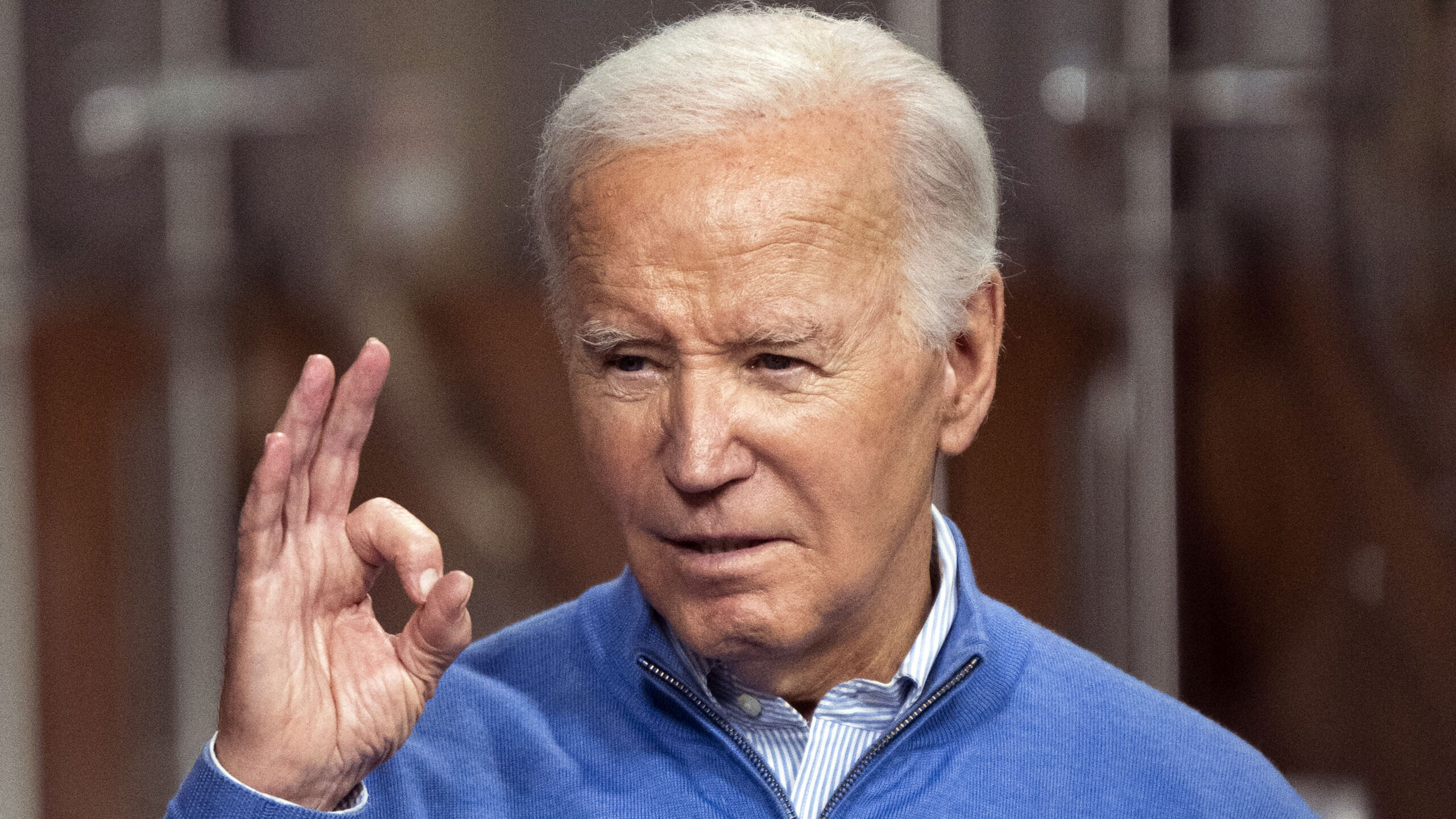

WASHINGTON (Reuters) – Federal Reserve officials agreed they needed to raise interest rates to a more restrictive level – and then maintain them there for some time – in order to meet their goal of lowering inflation, a readout of last month’s policy meeting showed on Wednesday.

The minutes of the Sept. 20-21 meeting showed many U.S. central bank officials “emphasized the cost of taking too little action to bring down inflation likely outweighed the cost of taking too much action.”

At the meeting, many officials said they had raised their assessments of the path of interest rate increases that would likely be needed to achieve the policy-setting committee’s goals.

That said, several participants in the discussion said it would be important to “calibrate” the pace of further policy tightening with the aim of mitigating the risk of significant adverse effects on the economic outlook.

At last month’s meeting, Fed officials raised interest rates by three-quarters of a percentage point for the third straight time in an effort to drive inflation down from 40-year highs, and Fed Chair Jerome Powell vowed afterward that they would “keep at it until we’re confident the job is done.”

Since the meeting, policymakers have been united in their comments that they see an urgent need to address inflation, which they fear risks becoming embedded, even if their aggressive policy tightening comes at a cost of higher unemployment.

The minutes from the meeting underscored that view. Several policymakers “underlined the need to maintain a restrictive stance for as long as necessary, with a couple of these participants stressing that historical experience demonstrated the danger of prematurely ending periods of tight monetary policy designed to bring down inflation,” the minutes showed.

TURNING POINT

The last several weeks have marked a turning point for financial markets that for much of the year had clung to a conviction that the Fed would swiftly reverse course next year and cut rates in the face of slowing growth and higher joblessness. Fed officials have openly pushed back on that expectation, saying they expect to leave rates elevated for some time after they have finished lifting them.

As markets have fully digested the Fed’s hawkishness, the result has been crushing losses for U.S. stock markets, rapidly rising yields on government debt and a surging dollar that has aggravated weak conditions in overseas markets.

Policymaker projections released at last month’s meeting show the Fed’s target policy rate, currently in a range of 3.00%-3.25%, its highest since 2008, rising to the 4.25%-4.50% range by the end of this year and ending 2023 at 4.50%-4.75%. The year-end 2022 projection suggests one more 75-basis-point hike is likely at the central bank’s remaining two meetings of the year.

Recent inflation data has shown little to no improvement despite the Fed’s aggressive tightening – it also announced 75-basis-point rate hikes in June and July – and the labor market remains robust with wages increasing solidly as well.

After the release of the minutes on Wednesday, financial markets continued to reflect expectations for the Fed to raise interest rates by another 75 basis points next month, and then downshift to a half-percentage-point hike in December and a quarter-percentage-point increase early in 2023. But prices in futures contracts maturing later next year showed investors are adding to bets the Fed will reverse course and begin cutting rates in the third or fourth quarter of 2023.

(Reporting by Dan Burns and Ann Saphir; Editing by Paul Simao)

" Conservative News Daily does not always share or support the views and opinions expressed here; they are just those of the writer."