Explainer-Credit Suisse: How did it get to crisis point?

By Anshuman Gadaga

(Reuters) – Credit Suisse Group AG Chief Financial Officer Dixit Joshi and his team will hold meetings over the weekend to assess strategic scenarios for the embattled Swiss bank as it enters a make-or-break weekend.

Credit Suisse received a $54 Billion lifeline from the Swiss central banks on Thursday. It was intended to help stabilize liquidity after fears of a global bank crisis intensified by a slump in shares and bonds. Analysts said that this might not be enough.

WHAT EVENTS CAUSED THE RECENT SHARE SLUMM?

The 167-year-old Swiss lender is in a mess because of a string of scandals, top management changes and multi-billion-dollar losses.

Credit Suisse shares fell in 2021 after losses resulting from the collapse of Archegos Capital and Greensill Capital.

Antonio Horta Osorio was fired as chairman of the bank in January 2022 for violating COVID-19 rules. This just eight months after he had been hired to help fix it.

In July, new CEO and restructuring expert Ulrich Koerner unveiled a strategic review – but failed to win over investors. Customers fled fleeing a rumour that the bank would fail in autumn, which was unfounded.

Credit Suisse confirmed that clients had pulled 110 Billion Swiss Francs ($119 Billon) of funds in the fourth-quarter, while the bank lost 7.29 billion Swiss Francs annually. Credit Suisse had reached out to investors in December for 4 billion Swiss Francs.

Saudi National Bank was the bank’s main backer on Wednesday. It said it couldn’t provide more money because it was limited by regulatory hurdles. But it was pleased with the bank’s turnaround plans.

Credit Suisse shares lost 75% in the past 12 months.

Graphic: Credit Suisse and its problems https://www.reuters.com/graphics/CREDITSUISSEGP-STOCKS/akveqegdgvr/chart.png

WHAT STEPS CAN CREDIT-SUISSE TAKE TO CALM INSIDERORS?

Credit Suisse claimed it would borrow up $54 billion to boost liquidity and investor confidence, but analysts think that this is unlikely to be enough for investors.

To boost confidence in the market, one option is to get the support of strategic investors. It includes Oyalan Group, a Saudi conglomerate, and Qatar Investment Authority as its investors.

UBS invested in the Singapore sovereign wealth fund GIC in the early days of 2008’s global financial crisis. However, the stake sale-down eventually resulted in a loss. This is a cautionary tale to potential backers.

Credit Suisse is able to divest stakes in different assets. Credit Suisse also has an asset management business and stake in SIX Group which operates the Zurich stock market.

The bank has decided to cater to wealthy clients and cut back on volatile investment banking. Plans have already been announced to spin it off.

One source said that Swiss regulators encourage UBS and Credit Suisse mergers, but they did not want to do so.

HOW IMPORTANT IS CREDIT SUISSE

This bank is ranked among the top wealth managers in the world and, crucially, it is one the 30 global systemically significant banks. A failure of this bank would have ripple effects throughout the financial system.

Credit Suisse also has an investment banking, wealth management and asset management operation. It employs just over 50,000 people and has 1.3 trillion Swiss Swiss Francs of assets under management at the close of 2022. This is down from 1.6 billion a year ago.

Credit Suisse, with more than 150 offices across 50 countries, is the private banking institution for many entrepreneurs, ultra-rich people, and companies.

($1=0.9258 Swiss francs)

Reporting by Anshuman Daaga and Swiss bureau; additional reporting and editing by Karin Strohecker and Sumeet Chaterjee. Kirsten Donovan and Elisa Martinuzzi edited.

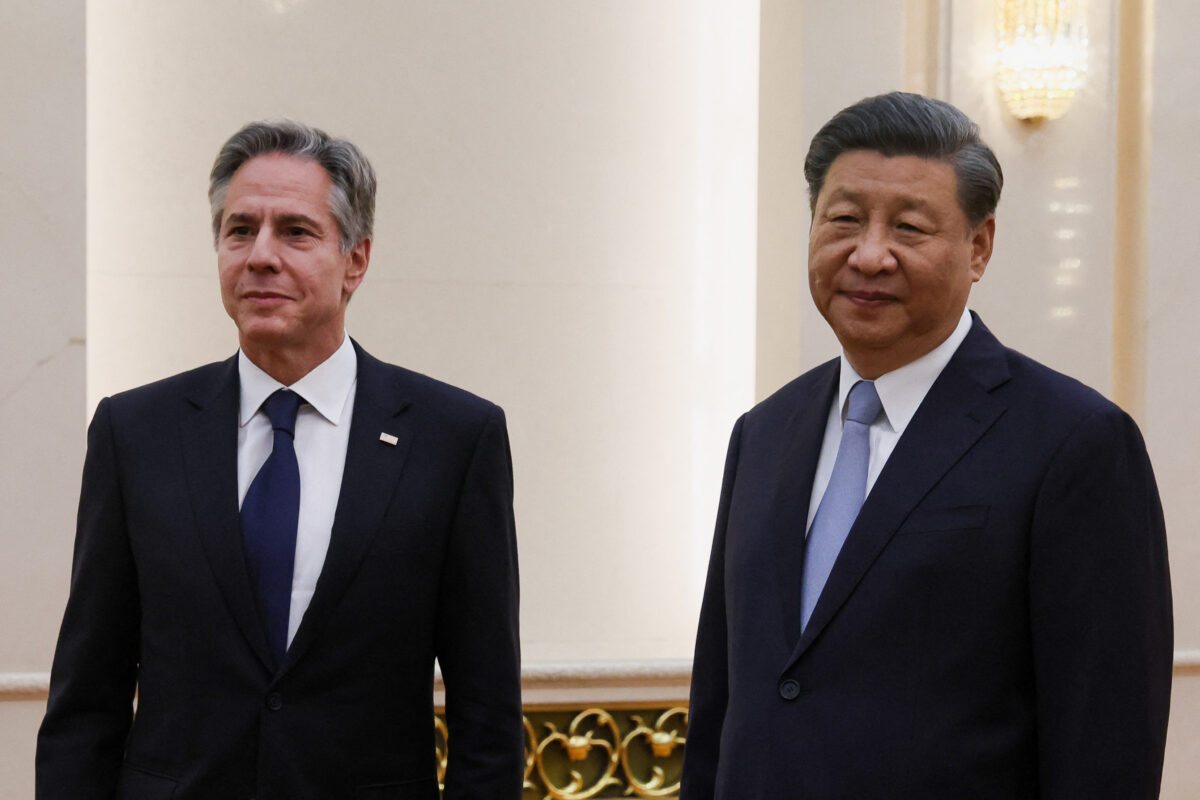

New financial documents reveal deeper ties between Biden’s family and the Chinese Communist Party.

The author of ‘Rich dad poor dad, who infamously predicted the 2008 crisis, warns of ‘serious trouble’ for the U.S. bond market.

The Biden administration has released footage of the moments leading to Russia’s downing a U.S. drone.

OAN NewsroomUPDATED 5:00 PM – Friday, March 17, 2023 The town of Sedona in Arizona recovers after mass flooding. One America’s James…

SHANGHAI (Reuters) -Baidu and Pony.ai said on Friday they have won permits to provide fully driverless ride-hailing services in the Chinese capital…

By Stephen Nellis and Krystal Hu (Reuters) -Huawei Technologies Co Ltd has replaced more than 13,000 parts in its products that were…

By Victor Pinheiro SAO PAULO (Reuters) – The Brazilian government is studying whether to regulate Internet platforms with content that earns revenue…

(Reuters) – Generative artificial intelligence has become a buzzword this year, capturing the public’s fancy and sparking a rush among Microsoft and…

“From Explainer Credit Suisse: What happened to it?”

“The views and opinions expressed here are solely those of the author of the article and not necessarily shared or endorsed by Conservative News Daily”

" Conservative News Daily does not always share or support the views and opinions expressed here; they are just those of the writer."