Examining Tax Policy: Senate focuses on fiscal responsibility in ‘big, beautiful bill’

The article from the Washington Examiner discusses current tax policy and the Senate’s focus on fiscal responsibility with the proposed “one big, gorgeous bill.” It features an exclusive interview with Senator todd Young (R-IN), who highlights the expiration of the Trump Tax Cuts and Jobs Act and the debate surrounding the SALT provisions in the reconciliation bill. Young emphasizes the need for a fiscally responsible government and points out that many constituents,notably in red states,demand this from their legislators. He expresses concern over the potential increase in taxes and advocates for reforming wasteful aspects of former President Biden’s Green new Deal subsidies.

Young also addresses the importance of Medicare and Medicaid, stating that while these programs are crucial, they must be managed properly to avoid taxpayer waste. He notes a disconnect between public opinion and political desires regarding tax policies, with a meaningful majority of Americans believing that any tax increases would strain their ability to cover essential goods. The article stresses Young’s support for simplifying tax processes while maintaining a commitment to fiscal responsibility.

Examining Tax Policy: Senate focuses on need for fiscal responsibility in ‘big, beautiful bill’

The Washington Examiner is examining tax policy by speaking to members of Congress and economics experts to answer voters’ questions about the “one big, beautiful bill” making its way through the Senate.

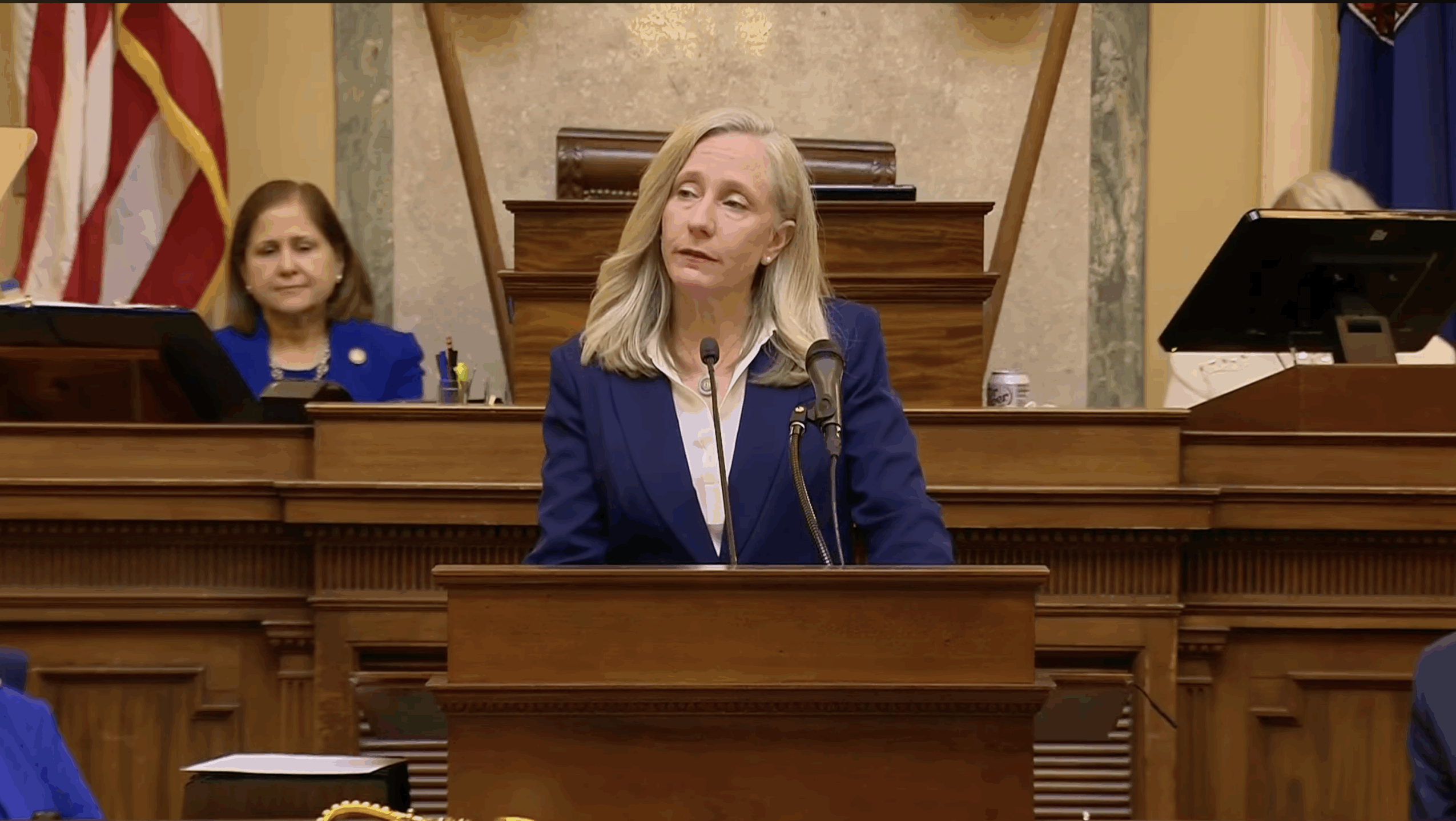

Sen. Todd Young (R-IN) joined the Washington Examiner for an exclusive interview to discuss the expiration of the Trump Tax Cuts and Jobs Act and the opposition to the SALT provisions in the reconciliation bill. Young said he knows how much his constituents value emphasizing the need for fiscal responsibility.

“People in red states … they demand fiscally responsible government,” Young said. “They demand it from their own governments, and they certainly demand that their federal legislators go to bat for them so they don’t have to subsidize other state and local profligacy. That’s essentially what many Democrat colleagues want to happen in this legislation. I hope they don’t prevail, and I hope we have enough Republican colleagues push back against the SALT provisions.”

Young supports the House Freedom Caucus‘s push for reforming former President Joe Biden’s Green New Deal subsidies to eliminate waste, fraud, and abuse, especially when it comes to expediting the imposition of Medicaid work requirements.

“The Freedom Caucus has been a really important voice throughout this whole tax reform debate,” Young said.

Regarding Medicare and Medicaid, Young acknowledged that these are important programs to Americans, but they cannot be abused.

“However, they were intended for certain purposes, and those purposes are being ignored,” Young said. “We’re seeing a lot of wasted taxpayer dollars as we think about the debt, trillions of dollars of debt that we’re passing on to our children and grandchildren. It is essential that we save every spare penny and either leave it with the American people as they take care of their families, or make sure that we’re paying down some of those obligations as we head into the future.”

EXAMINING TAX POLICY: HOPES FOR THE ‘BIG, BEAUTIFUL BILL’ TO SIMPLIFY TAXES

According to a Fabrizio Lee poll commissioned by the National Taxpayers Union, 80% of Americans said that if their taxes increased, they would not be able to afford essential goods. However, only 52% (88% Republican and 15% Democrat) of Americans want to extend the TCJA. Young addressed the disconnect between the parties’ desires to extend the 2017 tax law.

“You actually have fewer Americans who have to itemize their finances because we doubled the standard deduction last time,” Young said. “That means, a whole lot of people can, with very little compliance costs, go ahead and fill out taxes very quickly. It’s not something they have to worry about a lot. So that, understandably, among some Americans, led to less familiarity with the details of the last tax reform because they didn’t have to worry about the complication. So they can thank the Republican Party for simplifying their lives, even if it is an unusual byproduct, causing some people to be less familiar with the details.”

" Conservative News Daily does not always share or support the views and opinions expressed here; they are just those of the writer."